With U.S. markets closed in observance of Presidents Day, global financial markets took center stage, showcasing mixed sentiments across different regions and sectors. Europe’s Stoxx 600 index saw a modest rebound, while Asian markets presented a mixed picture, influenced by the People’s Bank of China’s policy decisions and optimistic travel data from China. Meanwhile, the currency and commodity markets remained relatively stable, with minor movements in major currency pairs and commodities like gold seeing a slight rise. Key economic events, including policy decisions from the Reserve Bank of Australia and the People’s Bank of China, along with Canada’s CPI report, are highly anticipated by investors, potentially setting the tone for future market movements.

The U.S. markets were closed on Monday in observance of Presidents Day, leading to a day where international markets garnered more attention. In Europe, the Stoxx 600 index managed a modest recovery, ending the day by 0.17%, a slight rebound from its negative performance in the morning session. Sector-wise, there was a mixed picture; mining stocks experienced a downturn, dropping by 1%, whereas healthcare stocks moved in the opposite direction, recording a gain of 0.95%. This divergence highlights the varied investor sentiments across different sectors within the European stock market landscape.

In company-specific news, shares of the Swiss software firm Temenos saw an impressive jump of 8.8%, bouncing back from the significant losses it suffered following a negative report from Hindenburg Research. On the other side of the globe, in the Asia-Pacific region, the stock market outcomes were mixed. Chinese markets showed optimism as traders returned from the Lunar New Year holidays, encouraged by promising travel data, while the Hong Kong stock market faced a downturn. The monetary policy stance of the People’s Bank of China, which held a key policy rate steady, also played a crucial role in shaping market expectations, especially in a global context where the timing of the U.S. Federal Reserve’s policy easing remains a focal point of speculation.

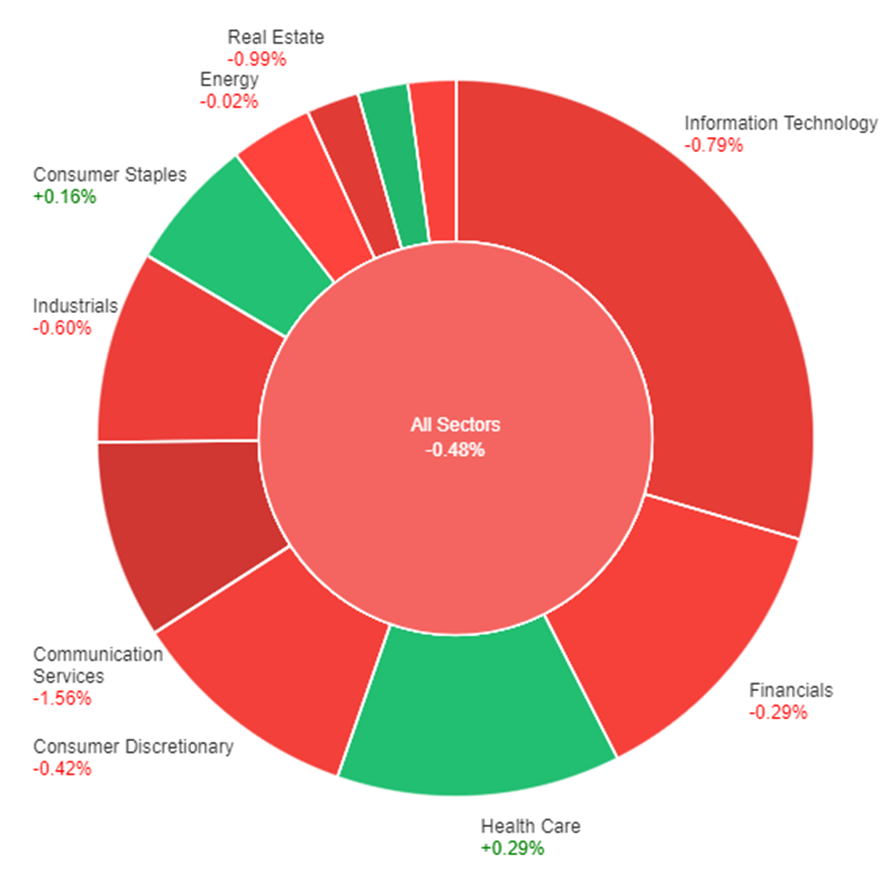

Data by Bloomberg

On Friday, the overall market saw a slight downturn, closing down by 0.48%. Despite the general negative sentiment, some sectors managed to post gains, with Materials leading the way with a 0.51% increase, followed by Health Care and Consumer Staples, which rose by 0.29% and 0.16%, respectively. On the flip side, the Communication Services sector faced the steepest decline at -1.56%, and Real Estate and Information Technology also experienced significant losses, dropping by -0.99% and -0.79% respectively. Other sectors such as Energy and Utilities saw marginal decreases, while Financials, Consumer Discretionary, and Industrials also ended the day in the red, highlighting a mixed but overall bearish performance across the market. Adding to the context, the US market was closed on Monday, suggesting that these movements were the last recorded before a day of inactivity in the trading sessions.

In the recent currency market updates, major currency pairs have shown minimal movement, adhering to their familiar trading ranges, influenced by the holiday closures in the United States and Canada. Despite this lull, a cautious optimism permeated the financial markets, reflected in the performance of some European and Japanese stock indexes as they neared record highs. The Euro to US Dollar (EUR/USD) exchange rate remained just below the 1.0800 mark, while the British Pound to US Dollar (GBP/USD) hovered around 1.2600. The GBP gained momentum during the European trading session, although it saw a slight retreat before the day’s end. Meanwhile, the US Dollar saw modest gains against traditionally safe-haven currencies such as the Swiss Franc (CHF) and the Japanese Yen (JPY), hinting at a buoyant mood within the financial markets.

On the commodity front, the Australian Dollar recorded a slight increase against the US Dollar, with the AUD/USD pair trading near 0.6540. In contrast, the Canadian Dollar depreciated against its US counterpart, approaching the 1.3500 level. These movements come ahead of significant macroeconomic events slated for early this week. The Reserve Bank of Australia (RBA) is expected to release its Meeting Minutes, which market participants will scrutinize for indications on future monetary policy, especially concerning inflation control and rate adjustments. Additionally, the People’s Bank of China (PBoC) is set to announce its decision on interest rates, specifically the Loan Prime Rate (LPR), which could influence global financial sentiments. Meanwhile, Canada’s upcoming Consumer Price Index (CPI) report for January is anticipated to show a 0.4% month-over-month increase, potentially impacting the CAD’s performance. Furthermore, spot Gold has seen a rise for three consecutive days, briefly surpassing the $2,020.00 mark, adding another layer of complexity to the market dynamics as investors await these critical economic updates.

EUR/USD Sees Limited Movement Amid Quiet Macro Calendar and Mixed Market Sentiment

On Monday, the EUR/USD pair experienced limited investor engagement, ending the day with slight gains in the 1.0780 area, amidst a narrow trading range. The lack of significant macroeconomic data and the closure of US and Canadian markets contributed to the subdued activity. While the US dollar showed general weakness against a backdrop of mixed stock market performances, optimism in some Asian and European stock indexes did not translate into a clear direction for FX traders. The Euro’s muted response followed the Deutsche Bundesbank’s report suggesting a recession in Germany, attributed to weak demand and cautious investment. Looking ahead, a light macroeconomic calendar and anticipation for the Federal Open Market Committee (FOMC) meeting minutes release are likely to influence future trading dynamics, with the market seeking clues on monetary policy amidst recent inflation developments.

On Monday, the EUR/USD moved in consolidation, fluctuating between the middle and upper bands of the Bollinger Bands. Currently, the price is moving slightly above the middle band, suggesting a potential slight upward movement to reach above the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 52, signaling a neutral outlook for this currency pair.

Resistance: 1.0796, 1.0830

Support: 1.0745, 1.0713

XAU/USD Gains Amidst Dollar Weakness and Mixed Market Sentiments

In Monday’s trading session, Gold (XAU/USD) saw an uptick, advancing to $2,023.04 a troy ounce in the first half, driven by a diminishing demand for the US Dollar before settling around $2,016 after the Dollar regained some strength. The broader financial markets experienced subdued volatility, attributed to holidays in Canada and the US, and a light macroeconomic calendar. Despite this, Asian and European markets offered mixed signals, with Chinese stocks gaining post-holiday and the Nikkei 225 nearing record highs before closing lower. European markets ended mixed but close to record levels. The financial landscape is currently absorbing recent US inflation data, which exceeded expectations, reducing the likelihood of an imminent rate cut by the Fed, with markets eagerly awaiting the upcoming FOMC Meeting Minutes for further direction.

On Monday, XAU/USD moved lower after reaching the upper band of the Bollinger Bands. Currently, the price is moving between the upper and middle bands, suggesting a potential downward movement toward the middle band. The Relative Strength Index (RSI) stands at 54, signaling a neutral outlook for this pair.

Resistance: $2,023, $2,038

Support: $2,010, $1,997

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Monetary Policy Meeting Minutes | 08:30 | |

| CAD | Consumer Price Index m/m | 21:30 | 0.4% |