On Tuesday, the stock market displayed mixed outcomes with the S&P 500 and Nasdaq Composite experiencing slight gains, while the Dow Jones Industrial Average faced a minor decline amidst anticipation for upcoming inflation data. Corporate earnings, particularly from Macy’s and Lowe’s, alongside economic indicators, played significant roles in market dynamics. Meanwhile, the currency market witnessed subtle shifts, with the Japanese yen strengthening against the dollar following Japan’s higher-than-expected core CPI report. Investor focus remains on key economic releases, including the personal consumption expenditure price index, with global monetary policy expectations influencing market sentiment.

On Tuesday, the stock market saw mixed results as investors awaited crucial inflation data expected later in the week. The S&P 500 edged up by 0.17% to 5,078.18, while the Nasdaq Composite saw a modest increase of 0.37%, closing at 16,035.30. Contrarily, the Dow Jones Industrial Average experienced a slight downturn, dropping by 96.82 points, or 0.25%, to end at 38,972.41. Notable movements included Macy’s, which surged 3.4% after announcing plans to close approximately 150 underperforming stores due to a previous revenue shortfall. Additionally, Lowe’s shares increased by 1.7% following an earnings beat, with Zoom Video and Hims & Hers Health also making significant gains after surpassing Wall Street’s earnings expectations.

A mix of corporate earnings reports and economic indicators influenced the market’s dynamics. The utilities sector led the market with a 1.9% increase, while the communications services and technology sectors also saw gains. This activity followed a decline from record highs the previous week, spurred by Nvidia’s impressive earnings. Moreover, investor sentiment was affected by a drop in consumer confidence amid concerns over a potential labor market slowdown and a divisive political climate, as reported by the Conference Board. Additionally, a decrease in orders for long-lasting goods in January, particularly in transportation, underscored these economic uncertainties. As investors look ahead, the forthcoming release of the personal consumption expenditure price index and personal income data will be closely scrutinized for insights into economic health and monetary policy direction.

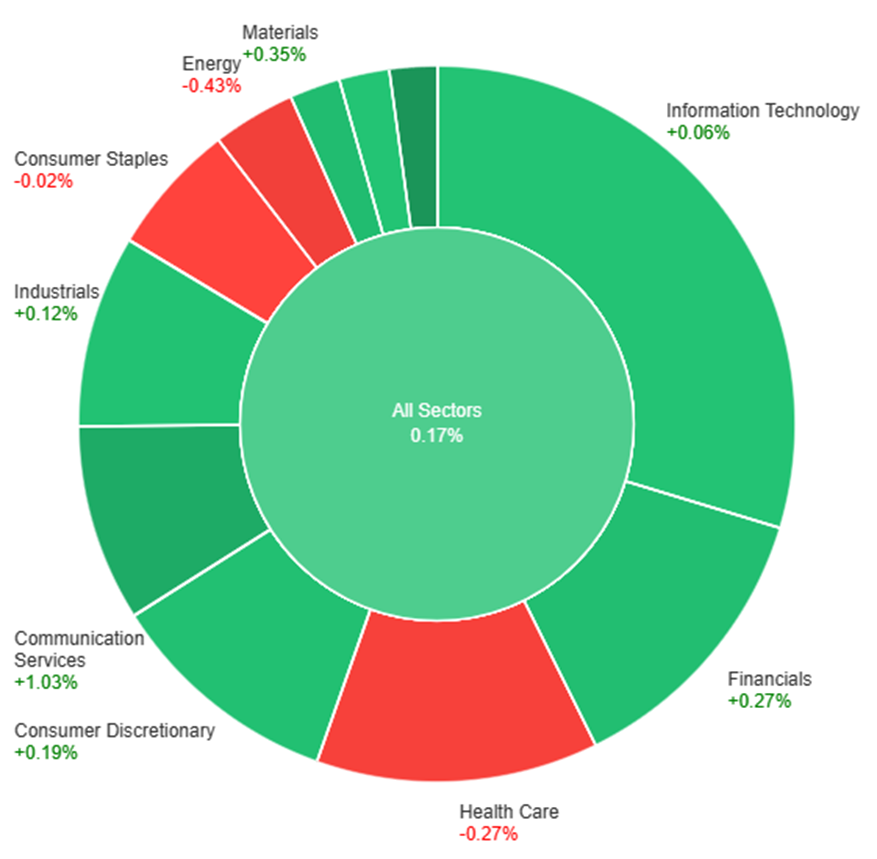

Data by Bloomberg

On Tuesdayday, the overall market saw modest gains, with all sectors collectively up by 0.17%. Utilities led the performance with a significant increase of 1.89%, followed by Communication Services and Materials, which rose by 1.03% and 0.35%, respectively. Financials, Consumer Discretionary, and Industrials also experienced gains, though more modest, ranging from 0.12% to 0.27%. Information Technology and Real Estate sectors saw minimal increases, whereas Consumer Staples, Health Care, and Energy sectors faced declines, with Energy recording the largest drop at -0.43%.

The currency market saw nuanced movements with the dollar index slightly declining by 0.09%, influenced by a mix of supportive corporate month-end flows and weaker-than-expected U.S. economic data concerning durable goods and consumer confidence. The Japanese yen emerged as a notable performer, appreciating following a report that showed Japan’s core CPI rising above forecasts. This development came amidst static policy pricing from major central banks such as the Federal Reserve, European Central Bank, and the Bank of Japan, with the market participants keenly awaiting further key data releases scheduled for later in the week and the next.

The FX landscape was further characterized by the lingering weakness of the USD against the JPY, spurred by Japan’s inflation data, while the EUR/USD, GBP/USD, and other major currency pairs saw marginal gains. Despite some reasons to overlook the disappointing U.S. durable goods data, attributed partly to Boeing’s challenges, the misses in economic reports have heightened the anticipation for upcoming releases on core PCE, income, spending, and employment data. Market speculation regarding the Federal Reserve’s interest rate path remains a focal point, especially after Kansas City Fed President Jeffrey Schmid’s hawkish remarks, contrasting with the market’s reduced expectations for Fed rate cuts. The evolving monetary policy expectations for the ECB, BoE, and BoJ also play a critical role in shaping the currency market dynamics, with all eyes on the upcoming eurozone CPI and U.S. core PCE data to gauge potential shifts in monetary policy and currency valuations.

EUR/USD Stabilizes Amid Anticipation of Key Economic Data

The EUR/USD pair has been hovering around the 1.0850 mark, showing little movement as traders await impactful economic releases. Following a more significant than expected decline in US Durable Goods Orders for January, market focus now shifts to upcoming US GDP figures, German Retail Sales, CPI data, and the US PCE inflation report. These forthcoming data points are crucial for gauging the economic health of both regions and could potentially influence the currency pair’s direction.

On Tuesday, the EUR/USD moved slightly lower and was able to reach the middle band of the Bollinger Bands. Currently, the price is moving around the middle band, suggesting a potential downward movement to reach below the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 53, signaling a neutral outlook for this currency pair.

Resistance: 1.0858, 1.0896

Support: 1.0823, 1.0783

XAU/USD See Modest Gains Amid Weakening Dollar and Anticipation for Key Economic Reports

Gold (XAU/USD) experienced a slight increase in its price during Tuesday’s mid-North American session, trading at $2,034.88, a 0.18% gain, amid a backdrop of falling US Treasury bond yields and a weakening US Dollar, as indicated by a 0.05% drop in the US Dollar Index (DXY). This modest uptick occurs as the precious metal hovers around the 50-day Simple Moving Average, with investors keenly awaiting the Personal Consumption Expenditures (PCE) report and latest Gross Domestic Product (GDP) data, which are anticipated to be significant factors that could drive Gold out of its current $2,020-$2,050 trading range. The outlook is further clouded by the recent report on Durable Goods Orders for January, which fell more sharply than expected, and mixed Home Prices data, suggesting a potentially volatile period ahead for Gold prices.

On Tuesday, XAU/USD moved lower to reach the middle band of the Bollinger Bands. Currently, the price is moving just above the middle band, suggesting a potential consolidation movement. The Relative Strength Index (RSI) stands at 53, signaling a neutral outlook for this pair.

Resistance: $2,042, $2,056

Support: $2,030, $2,017

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | CPI y/y | 08:30 | 3.4% (Actual) |

| NZD | Official Cash Rate | 09:00 | 5.50% (Actual) |

| NZD | RBNZ Monetary Policy Statement | 09:00 | |

| NZD | RBNZ Rate Statement | 09:00 | |

| USD | Prelim GDP q/q | 21:30 | 3.3% |