The stock market closed with mixed results as the Nasdaq Composite sustained its longest losing streak since October 2022, dropping by 0.56% while the S&P 500 experienced its fourth consecutive decline. Mega-cap tech stocks, especially Apple, faced significant underperformance due to valuation concerns and Federal Reserve uncertainties. Despite this downturn, some analysts remain optimistic about long-term prospects, expecting the S&P 500 to potentially reach 5,000 by year’s end. Meanwhile, in the currency market, the US Dollar Index showed fluctuations, influenced by investor caution ahead of crucial NFP figures and positive ADP readings. Major currency pairs reacted differently to economic data and risk sentiment, shaping their dynamics against the US dollar, while gold and silver regained momentum amidst the shifting landscape.

The stock market closed with mixed results as the Nasdaq Composite sustained its longest losing streak since October 2022, sliding by 0.56% to 14,510.30. This decline reflects a broader trend, with the index losing nearly 4% since its closing on December 27. Conversely, the S&P 500 experienced a fourth consecutive day of declines, dropping by 0.34% to 4,688.68, while the Dow Jones Industrial Average managed a slight gain of 0.03% to close at 37,440.34. Mega-cap tech stocks like Apple faced substantial underperformance due to concerns over inflated valuations and uncertainty about the Federal Reserve’s potential rate cuts. Apple specifically saw a more than 5% decrease in stock value this week, further exacerbated by recent downgrades from Piper Sandler and Barclays.

Despite the recent market downturn, some analysts remain optimistic about the market’s long-term prospects. He downplays the significance of the recent pullback, considering it more of a statistical fluctuation rather than a substantial indicator of market direction. Suggesting the potential for the S&P 500 to reach around 5,000 by the year’s end, indicating a more than 6% upside from the current levels, highlighting his positive outlook amid the present market fluctuations.

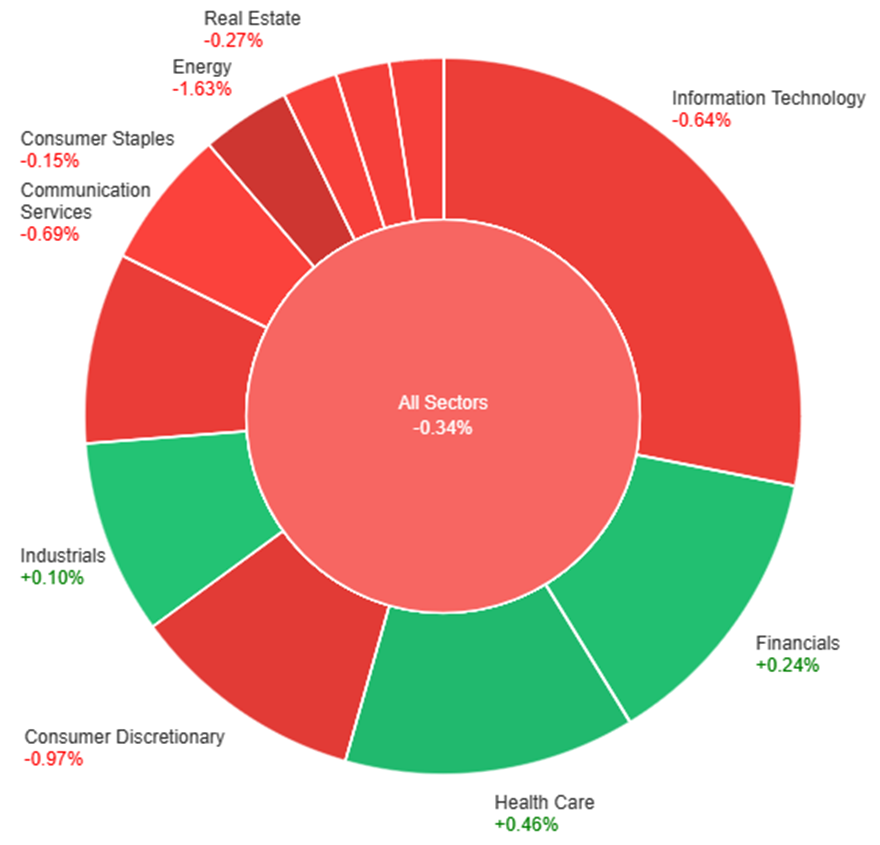

Data by Bloomberg

On Thursday, the overall market experienced a slight dip of 0.34%. Among the sectors, Health Care saw a positive uptick of 0.46%, followed by Financials at 0.24% and Industrials at 0.10%. On the downside, Energy suffered the most with a significant decrease of 1.63%, while Consumer Discretionary, Communication Services, and Information Technology also faced notable declines of 0.97%, 0.69%, and 0.64%, respectively. Additionally, Consumer Staples, Real Estate, Utilities, and Materials all experienced minor decreases ranging from -0.15% to -0.33%.

In the latest currency market updates, the US Dollar Index (DXY) showcased a fluctuating performance, hovering around 102.40 following a brief dip to 102.00. Investor caution before the release of crucial NFP figures boosted the dollar amidst mixed risk appetite trends. The positive ADP readings reinforced optimism for December Payrolls, aligning with a rebound in US stocks that revisited the 37700 zone according to the Dow Jones index. The dollar found support from market digestion of the somewhat hawkish tone in the FOMC Minutes and a robust ADP report, while weekly Initial Claims rose by 202K in the week to December 30.

Meanwhile, the EUR/USD pair recovered some ground, touching the 1.0970 zone, and encountering initial resistance despite German flash inflation figures revealing a 3.7% CPI rise in December. GBP/USD initially surged past 1.2700 on upbeat final Services PMI data for December but later retreated to around 1.2660. In contrast, the Japanese yen faced sustained selling pressure, propelling USD/JPY toward the 145.00 barrier amid increased risk appetite and rising US yields. AUD/USD experienced its fifth consecutive drop despite the absence of clear direction in the US dollar and positive readings from China’s Caixin Services PMI. The Canadian dollar, despite weakening, aimed for a retest of two-week highs against the USD ahead of the Canadian labor market report.

Amidst this dynamic landscape, Gold regained momentum, testing the $2040 region per troy ounce, while Silver bounced back from three-week lows, reclaiming the $23.00 per ounce mark despite recent downward trends. The currency market showcased a mix of trends, influenced by economic data, risk sentiment, and fluctuations in key commodities, defining the movement of major currency pairs and their relationship with the US dollar.

EUR/USD Rebounds as Bulls Test Resistance Amidst USD Indecision and Hawkish FOMC Minutes

EUR/USD showed signs of recovery, touching the 1.0970/75 level after a bearish streak. The US dollar lacked clear direction around 102.40 amidst three-week high US yields triggered by a hawkish FOMC tilt, hinting at potential rate reductions by 2024. German inflation figures bolstered the euro, suggesting the ECB might maintain interest rates longer. Meanwhile, a robust ADP report in December hinted at strong Nonfarm Payroll readings, further shaping market sentiments. Bullish momentum faced resistance, indicating a potential standoff in the ongoing currency tussle.

On Thursday, the EUR/USD moved slightly higher and reached the middle band of the Bollinger Bands. Currently, the price moving around the middle band, suggesting a potential downward movement. Notably, the Relative Strength Index (RSI) maintains its position at 44, signaling a neutral but bearish outlook for this currency pair.

Resistance: 1.0980, 1.1068

Support: 1.0892, 1.0814

XAU/USD Holds Steady Around $2,040 Amidst Mixed US Data and Fed Meeting Minutes

XAU/USD maintained its position near $2,040 on Thursday after initial gains eased during the American session. The US Dollar faced slight pressure following a mix of US data and insights from the FOMC Meeting Minutes. Despite Fed Chair Jerome Powell’s mention of potential rate cuts, the Minutes didn’t unveil a clear timeline, hinting at a probable move in 2024. Concurrently, the ADP survey indicated robust job growth, surpassing expectations with 164K new positions and signaling alignment with pre-pandemic employment levels. With anticipation for Friday’s Nonfarm Payrolls (NFP) report projecting 170K new jobs, gold remains anchored amidst a landscape of nuanced economic signals.

On Thursday, XAU/USD moved in consolidation and tried to reach the middle band of the Bollinger Bands. Currently, the price moving just below the middle band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 44, signaling a neutral but bearish outlook for this pair.

Resistance: $2,050, $2,070

Support: $2,030, $2,009

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Employment Change | 21:30 | 12.2K |

| CAD | Unemployment Rate | 21:30 | 5.9% |

| USD | Average Hourly Earnings m/m | 21:30 | 0.3% |

| USD | Non-Farm Employment Change | 21:30 | 168K |

| USD | Unemployment Rate | 21:30 | 3.8% |

| USD | ISM Services PMI | 23:00 | 52.5 |