Stock futures edged lower on Thursday evening, despite the S&P 500 making headlines earlier in the day by briefly topping the 5,000 mark for the first time during intraday trading, before settling just below this historic level. This slight downturn in futures contrasted with the broader market’s optimism, as the S&P 500 celebrated reaching an all-time high and marked its fifth consecutive week of gains, reflecting confidence bolstered by strong earnings, easing inflation, and a resilient economy. Meanwhile, in currency markets, the dollar saw modest gains, particularly against the Japanese yen following comments from the Bank of Japan’s Deputy Governor. This financial landscape is shaped by mixed earnings reports, with Pinterest experiencing a drop after hours, and anticipation around PepsiCo’s upcoming earnings. The currency market’s dynamics, including movements in the EUR/USD and USD/JPY pairs, underline the global economic intricacies as central banks navigate inflation and interest rate expectations.

Stock futures saw a slight decline on Thursday evening, following a remarkable day where the S&P 500 briefly surpassed the 5,000 mark for the first time in its history during intraday trading. Futures for the Dow Jones Industrial Average fell by 30 points, while S&P 500 and Nasdaq 100 futures both experienced minor drops of around 0.1%. This downturn in futures came after the S&P 500 achieved an all-time high of 5,000.40 during regular trading hours, before closing just shy of this milestone. The index has seen significant growth, adding 1,000 points in nearly three years since it first crossed the 4,000 threshold on April 1, 2021. Factors such as a strong earnings season, easing inflation, and a resilient economy have contributed to a 4.8% increase in the S&P 500 for the year.

Amidst this backdrop of market milestones, the S&P 500 is poised to end the week 0.8% higher, marking its fifth consecutive weekly gain. Similarly, the Dow Jones and Nasdaq Composite are also on track for their fifth week of gains, with increases of 0.2% and 1.1%, respectively. These achievements are supported by robust earnings reports, with 319 companies of the S&P 500 having reported, and 80.6% surpassing analyst expectations, a notable improvement over the typical beat rate of 67% since 1994. However, not all news was positive, as Pinterest shares fell 6% in extended trading due to a disappointing forecast and revenue miss for the quarter, despite a later recovery following an app deal announcement with Google. PepsiCo is also in the spotlight, with its earnings report anticipated before the opening bell on Friday.

Data by Bloomberg

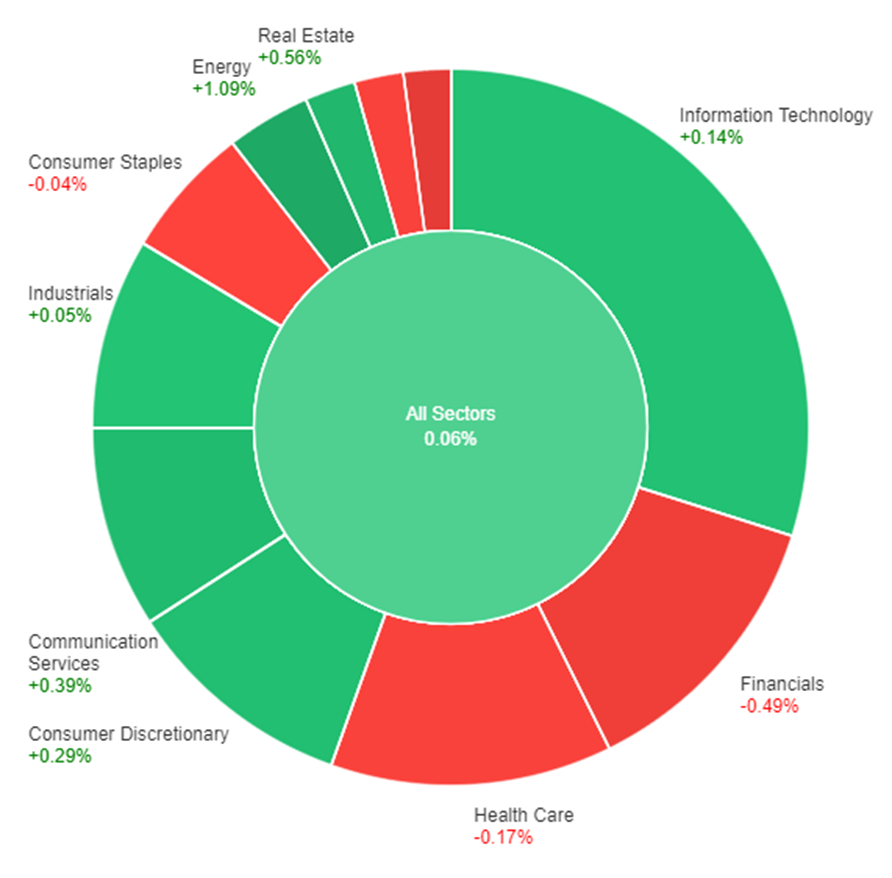

On Thursday, the overall market saw a modest increase of 0.06%, with sectoral performance showing a mixed but predominantly positive trend. Energy led the gains, surging by 1.09%, followed by Real Estate and Communication Services, which rose by 0.56% and 0.39%, respectively. Other sectors such as Consumer Discretionary and Information Technology also experienced growth, albeit at a more moderate pace. On the downside, Utilities faced the largest decline, dropping by 0.83%, while Financials and Materials sectors also saw decreases. The day’s trading reflected a varied investor sentiment across different sectors, highlighting both growth opportunities in areas like Energy and Real Estate and concerns in Utilities and Financials.

In the currency market, the dollar index witnessed a modest rise of 0.1%, driven largely by a notable 0.78% increase in the USD/JPY pair. This surge came after the Bank of Japan’s Deputy Governor, Shinichi Uchida, tempered expectations for a significant tightening of monetary policy following the anticipated end of negative interest rates in Japan. Additionally, the dollar received a temporary boost from U.S. jobless claims, which reported slightly below expectations, contrasting with the larger, unexpected increases observed in the previous week. This development aligns with the Federal Reserve’s stance, as indicated by the robust employment figures for January and the ISM services reports, advising against the premature anticipation of rate cuts. Market futures are now pricing in a 64% chance of a rate cut in May, with a total of 116 basis points of easing expected for the year.

In other currency movements, the EUR/USD pair remained steady despite touching earlier lows, finding support at the December and January lows amidst ongoing uncertainty from ECB policymakers regarding the inflation outlook. The reluctance to commit to rate cuts before more data is available—and possibly before the Fed’s anticipated rate cut on May 1—highlights the cautious approach of the European Central Bank. Meanwhile, the USD/JPY’s rally above significant resistance levels, driven by widening Treasury-JGB yield spreads, hints at a potential test of the 150 mark, contingent on upcoming U.S. CPI data. Should inflation figures exceed expectations, it could heighten the probability of revisiting the 32-year peaks seen in 2022/23. The British pound experienced a slight decline but remained above recent lows, amidst comments from BoE’s Catherine Mann advocating for a rate hike and signs of recovery in the UK housing market, contributing to a rise in 2-year Gilt yields.

EUR/USD Stabilizes Amid Mixed Signals from the Fed and ECB on Future Rate Decisions

The EUR/USD pair found itself in a stabilization phase around the 1.0770/80 mark as the US Dollar’s early gains dissipated, influenced by a late loss in momentum despite rising US yields. This shift occurred amidst ongoing investor speculation over the Federal Reserve’s potential easing in its May or June meetings, underscored by cautious tones from Fed Chair Jerome Powell and other Fed officials regarding interest rate adjustments. Meanwhile, European Central Bank (ECB) members expressed varied views on the timing of policy rate changes, adding to the currency pair’s uncertainty. Investors now eye the Fed’s next moves with a heightened focus on upcoming inflation data and the ECB’s stance on its policy rate, navigating through mixed signals on the economic outlook and monetary policy directions on both sides of the Atlantic.

On Thursday, the EUR/USD moved flat and was able to reach above the middle band of the Bollinger Bands. Currently, the price is moving just above the middle band with narrower bands, suggesting a potential slightly upward movement to reach the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 50, signaling a neutral outlook for this currency pair.

Resistance: 1.0817, 1.0880

Support: 1.0724, 1.0662

XAU/USD Exhibit Modest Losses Amid US Dollar Fluctuations and Economic Indicators

Gold (XAU/USD) experienced slight intraday losses, trading around $2,030 during the Thursday American session, amidst fluctuating US Dollar strength and key economic indicators. Despite a weak Dollar in Asian markets, it regained momentum before Wall Street opened, influenced by the yield on the 10-year US Treasury note, which rose to 4.16% following upbeat US employment data indicating a rise in weekly unemployment claims to 218K. This robust labor market data, alongside Federal Reserve officials’ remarks aligning with Chair Jerome Powell’s cautious stance on inflation, has led market participants to adjust their expectations for potential rate cuts, contributing to the day’s trading dynamics for gold.

On Thursday, XAU/USD moved higher and was able to reach above the middle band of the Bollinger Bands. Currently, the price is moving slightly above the middle band, suggesting a potential upward movement to reach back to the upper band. The Relative Strength Index (RSI) stands at 50, signaling a neutral outlook for this pair.

Resistance: $2,043, $2,062

Support: $2,031, $2,016

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Employment Change | 21:30 | 16.0K |

| CAD | Unemployment Rate | 21:30 | 5.9% |