U.S. stock futures held steady after a month marked by losses across major indices, as the Nasdaq Composite and S&P 500 finally halted their four-day negative streak. Futures tied to the Dow Jones Industrial Average dipped slightly by 0.1%, while S&P 500 and Nasdaq 100 futures also saw marginal declines of the same magnitude. During the main trading session, the Nasdaq Composite posted its most significant gain of the month, surging by 1.6%, and the S&P 500 recorded a nearly 0.7% increase. Impressively, these advances occurred even as the 10-year Treasury yield reached its highest level since November 2007, climbing by around 9 basis points to 4.34%. This simultaneous rise of tech-heavy stocks and yields drew attention in Wall Street, where the historically challenging relationship between tech shares and higher interest rates was defied. Despite the current optimism, analysts remain cautious, highlighting potential vulnerabilities associated with the recent Treasury yield surge, including impacts on refinancing and concerns for tech and growth stocks with high price-to-earnings ratios.

Looking ahead, market watchers await crucial corporate earnings releases from prominent retail giants Lowe’s and Macy’s, as well as Nvidia, a significant tech gainer that plays a pivotal role in gauging sentiment within the AI sector. Economic data releases, such as the Philadelphia Fed’s nonmanufacturing survey, Richmond Fed’s manufacturing survey results, and July’s existing home sales data, will also be scrutinized for insights into the health of the economy. Additionally, all eyes are on Fed Chairman Jerome Powell’s forthcoming remarks at Jackson Hole, expected to provide further clarity on the central bank’s perspective regarding inflation trends. This context underscores the delicate balancing act investors face as they assess the interplay between market performance, interest rates, and economic indicators in the months ahead.

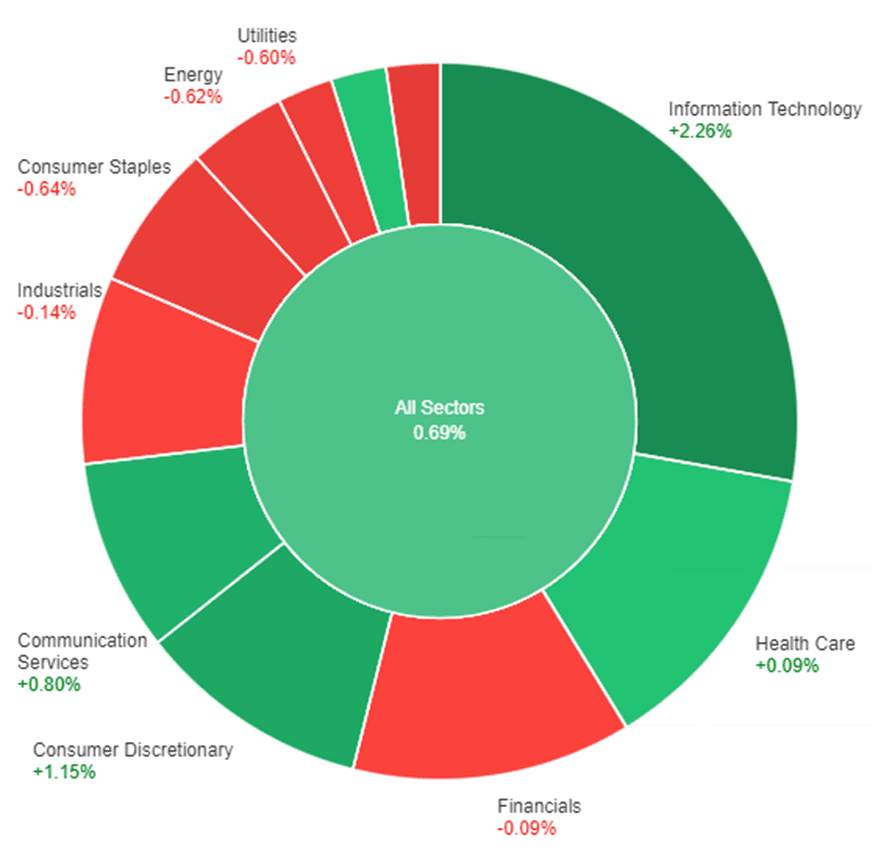

Data by Bloomberg

On Monday, the overall market displayed a positive trend with all sectors collectively gaining 0.69%. The Information Technology sector led the way with an impressive surge of 2.26%, followed by Consumer Discretionary at 1.15% and Communication Services at 0.80%. Health Care experienced a marginal uptick of 0.09%, while Materials and Financials saw minimal gains of 0.02% and -0.09% respectively. On the other hand, Industrials and Utilities witnessed slight declines of -0.14% and -0.60%, while Energy, Consumer Staples, and Real Estate faced more substantial decreases, sliding by -0.62%, -0.64%, and -0.88% respectively.

Major Pair Movement

On Monday, the US Dollar faced a slight decline as major currency pairs remained relatively stable due to a lack of significant macroeconomic events. Market sentiment stayed negative, causing government bond yields to rise. The US Treasury yield reached its highest point since 2007, reflecting concerns that global central banks might extend monetary tightening measures to control inflation.

China continued to face challenges, with reports showing a continued decline in government land sales revenue for the 19th consecutive month in July. The People’s Bank of China (PBoC) made a minor expected adjustment by reducing the one-year Loan Prime Rate by 10 basis points to 3.45%. However, this fell short of more aggressive expectations, causing the Yuan to weaken. UBS also lowered China’s 2023 real GDP growth forecast from 5.2% to 4.8%.

The German Bundesbank’s monthly report indicated that inflation might persist above central bank targets for a while, while Q3 growth is predicted to remain largely flat.

Currency pairs displayed varied trends: EUR/USD struggled to surpass 1.0900, GBP/USD appeared better positioned for gains at around 1.2740, the Australian Dollar gained against the US Dollar alongside rising Gold prices, and USD/CAD rose due to decreased oil prices impacting the Canadian Dollar.

USD/JPY traded above 146.00 and near its recent high of 146.53, with growing speculation that the Bank of Japan might need to adjust its ultra-loose monetary policy soon.

The upcoming week’s macroeconomic calendar had limited offerings, with attention turning to the Jackson Hole Symposium starting next Thursday. Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde were scheduled to speak on Friday, raising anticipation for potential hints about future policy decisions.

Picks of the Day Analysis

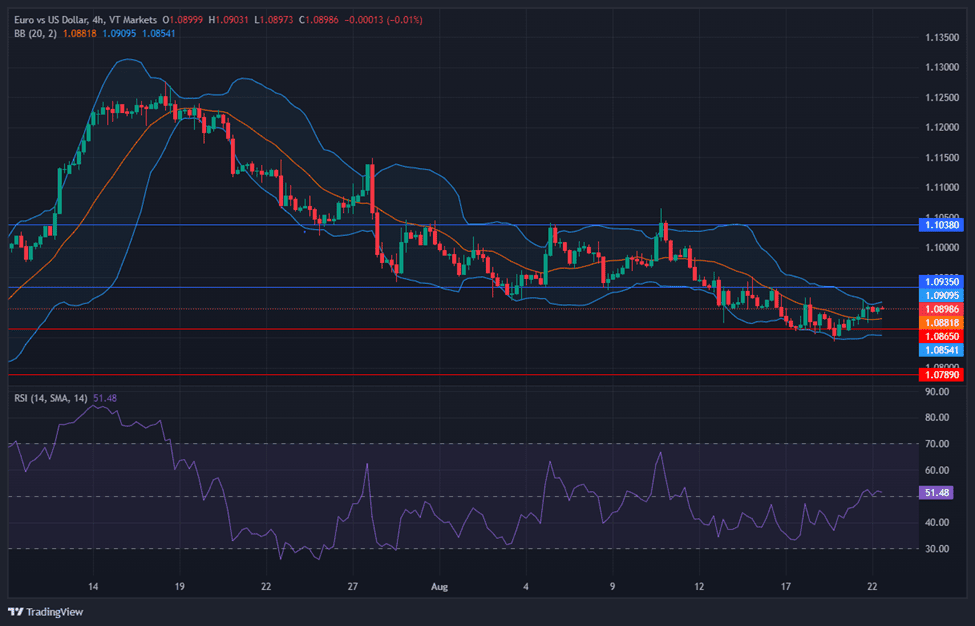

EUR/USD (4 Hours)

EUR/USD Holds Near 1.0900 Amid USD Struggles and Chinese Woes

The EUR/USD pair remains steady around 1.0900 as the US Dollar faces challenges despite a sour mood. Asian stocks dip due to ongoing Chinese real estate concerns, while the People’s Bank of China (PBoC) cuts rates as expected, impacting the Yuan. Global bond yields rise, led by the US 10-year Treasury note hitting a 2007 high. Germany sees mixed economic news, with Producer Price Index (PPI) decline but Bundesbank’s caution on inflation. Upcoming data includes Euro Zone’s June Current Account and US July Existing Home Sales and August Richmond Fed Manufacturing Index, alongside insights from Fed officials.

According to technical analysis, the EUR/USD moved higher on Monday and managed to reach the upper band of the Bollinger Bands. Currently, the price is slightly below the upper band of the Bollinger Bands. The Relative Strength Index (RSI) currently stands at 51, indicating that the EUR/USD is currently back in a neutral stance.

Resistance: 1.0935, 1.1038

Support: 1.0865, 1.0789

XAU/USD (4 Hours)

XAU/USD Recovers Briefly as USD Strengthens Amid Economic Uncertainties

Spot Gold hit a low of $1,884.77 on Monday before recovering slightly as XAU/USD responded to reduced US Dollar demand, eventually stabilizing around $1,890. The USD rebounded due to a deteriorating market sentiment, causing US indexes to dip and government bond yields, including the 10-year Treasury note, to surge to their highest levels since 2007, with the 2-year note nearing 5%. Growing concerns about a potential economic setback persist as global central banks remain cautious about ending the ongoing monetary tightening cycle, and worries intensify due to China’s currency struggles and limited action. The macroeconomic calendar offers little this week, heightening anticipation for insights from Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde at the Jackson Hole Symposium on Friday, as investors seek guidance on future directions.

Based on technical analysis, the XAU/USD moved higher on Monday and was able to move near the upper band of the Bollinger Bands. Currently, the price is moving just below the upper band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 48, indicating that the XAU/USD pair is now in a neutral stance.

Resistance: $1,899, $1,912

Support: $1,892, $1,885