The stock market soared to record highs as the Dow Jones Industrial Average closed at 37,248.35 points, marking a 0.43% increase, spurred by a drop in the 10-year Treasury note yield. This surge resonated in the S&P 500 and Nasdaq, both climbing upwards. Investor confidence in a potential soft economic landing for 2024 grew, with speculation about forthcoming rate cuts, especially after the Federal Open Market Committee hinted at possible reductions. Specific sectors, including solar stocks and Moderna, experienced substantial gains. Additionally, sectors like Energy and Real Estate thrived, while Utilities and Consumer Staples saw declines. In the currency market, the dollar index dropped significantly as the Bank of England and the European Central Bank diverged from the Federal Reserve’s dovish stance, influencing currency pairs like EUR/USD and Sterling, while USD/JPY faced downward pressure amidst expectations surrounding major central banks’ policies.

The stock market experienced a positive surge as the Dow Jones Industrial Average hit a record high, closing up by 0.43% at 37,248.35 points, following its previous milestone above 37,000. This increase was mirrored by the S&P 500, which rose by 0.26% to 4,719.55, and the Nasdaq Composite, which gained 0.19% to 14,761.56. These upticks were propelled by the 10-year Treasury note yield dropping below 4%, leading to increased investor confidence in a potential soft economic landing for 2024. This drop in interest rates spurred speculation about potential rate cuts for the upcoming year, with the Federal Open Market Committee indicating the possibility of three rate reductions.

Additionally, specific sectors saw notable movements. Solar stocks, including SunRun and Enphase, surged as the 10-year Treasury yield fell, with the Invesco Solar ETF (TAN) climbing over 8.1%. Moderna’s shares also rose by 9.3% after trial data revealed promising results for its cancer vaccine used in conjunction with Merck’s Keytruda. Looking ahead, the S&P 500 inches closer to its all-time closing record set in January 2022, sitting just 1.6% away, while the Nasdaq remains approximately 8% below its closing record and 9% from its intraday peak.

Data by Bloomberg

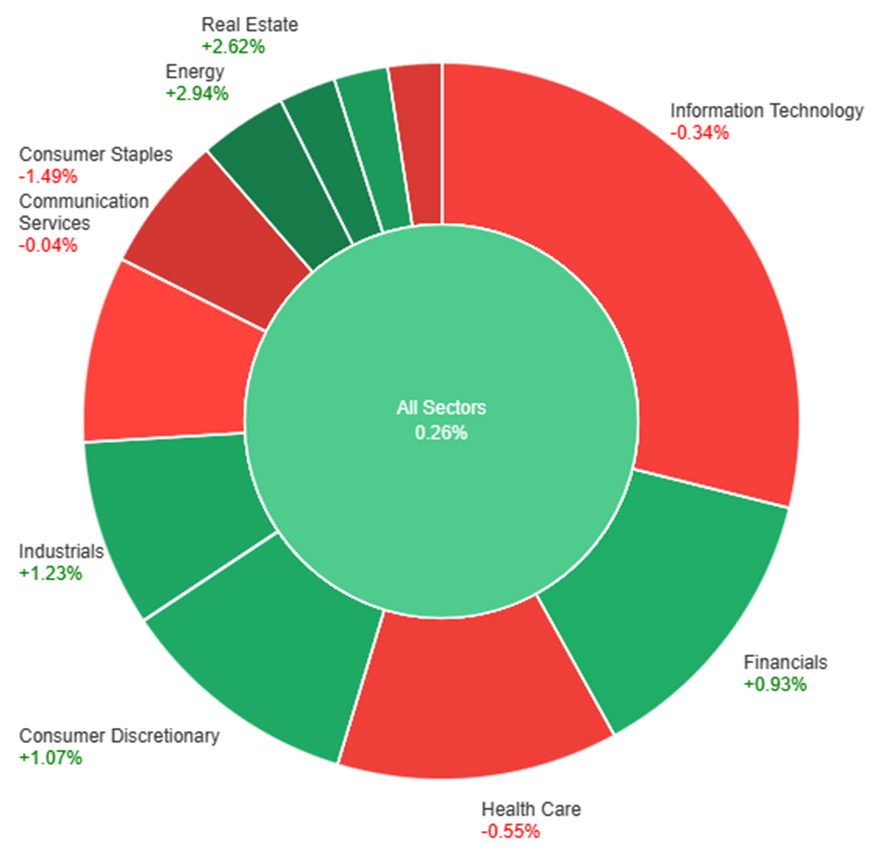

On Thursday, the overall market showed a positive trend, with a gain of 0.26%. The standout performers were Energy and Real Estate, surging by 2.94% and 2.62%, respectively. Materials and Industrials also experienced notable gains, rising by 1.68% and 1.23%. However, sectors like Utilities and Consumer Staples saw declines, with decreases of 1.28% and 1.49%, respectively. Communication Services remained relatively stable, showing a marginal decrease of 0.04%. Notably, Information Technology and Health Care experienced declines of 0.34% and 0.55%, respectively, contributing to the overall mixed performance across sectors.

In the currency market updates, the dollar index faced a significant decline by 1% after the Bank of England (BoE) and the European Central Bank (ECB) chose not to mirror the Federal Reserve’s dovish stance. This highlighted a trend where the U.S. central bank consistently leads major policy shifts during the pandemic. Despite a brief rebound in the dollar following positive U.S. retail sales and jobless claims, this momentum was overshadowed by the divergence between the Fed’s dovishness and the BoE and ECB’s reluctance to consider easing.

The BoE maintained elevated rates due to UK core inflation at 5.7%, substantially higher than the central bank’s target, while the ECB’s 4% rate remained notably lower compared to the BoE and Fed. Market futures now anticipate the Fed’s first rate cut in March, accumulating to 150 basis points by 2024. On the other hand, the ECB is slightly predicted to cut rates by March, aiming for nearly 150 basis points by year-end. The BoE is expected to cut rates by May, albeit by 106 basis points for 2024. Amidst this, currency pairs like EUR/USD surged by 1%, nearing November’s trend high, while Sterling rose by 1.36%, driven by the BoE’s resistance to rate cut expectations and benefited from risk-on flows.

USD/JPY experienced a decline from November’s peak, reaching 140.95 after the Fed’s pivot and ahead of crucial announcements from the BoE, ECB, and U.S. retail sales. Despite a retracement to 140.71, USD/JPY faced downward pressure, partly attributed to the expectation that the Bank of Japan (BoJ) stands alone among major central banks in considering a hike next year.

EUR/USD Soars Amidst Fed and ECB Policy Moves

The EUR/USD pair experienced a surge, hitting 1.1009 before a minor pullback, driven by contrasting central bank actions. The US Dollar faced pressure post-Fed, while the Euro gained ground following the ECB’s decision to maintain rates and continue PEPP reinvestments through H1 2024, with plans to reduce the portfolio by €7.5 billion monthly in H2. Despite expectations of a gradual inflation decline till 2024 and concerns over price pressures, ECB President Christine Lagarde clarified no discussions on rate cuts occurred. Additionally, the Dollar’s slide was compounded by a drop in Treasury yields. While positive US data on Retail Sales and Jobless Claims surpassed expectations, the focus remains on Friday’s release of S&P Global’s preliminary December PMIs for the EU and the US.

On Thursday, the EUR/USD moved higher and was able to reach the upper band of the Bollinger Bands. Currently, the price moving slightly below the upper band, suggesting a potential continuation movement, potentially reaching the resistance level at 1.1017. Notably, the Relative Strength Index (RSI) maintains its position at 77, signaling a bullish outlook for this currency pair.

Resistance: 1.1017, 1.1060

Support: 1.0963, 1.0912

XAU/USD Hold Steady Amidst Dollar Respite and Central Bank Divergence

Gold (XAU/USD) navigates a week of fluctuations, poised for a weekly gain after a retreat from record highs. The Asian market’s influence is marked by the US Dollar’s pause in its decline, propelled by a slight rebound in US Treasury bond yields. Amidst this, the US Dollar finds stability as Asian stocks trim early gains, awaiting pivotal preliminary PMI data from the US and Eurozone, crucial for gauging global economic health. The backdrop is a US Federal Reserve embracing a dovish stance, contrasting with the Bank of England and European Central Bank hinting at potential tightening, revealing a pronounced monetary policy divergence that weighs heavily on the dollar. Despite temporary Dollar recoveries due to unexpected US Retail Sales upticks, the dovish Fed outlook continues to fuel a global risk-on sentiment, supporting Gold prices near recent highs. As the week concludes, the focus remains on the PMI data’s impact and potential profit-taking amid a volatile week dominated by central bank actions.

On Thursday, XAU/USD moved in consolidation around the upper band of the Bollinger Bands. Currently, the price moving below the upper band, suggesting a potential continuation movement, potentially reaching the resistance level at $2,041. The Relative Strength Index (RSI) stands at 64, signaling a bullish outlook for this pair.

Resistance: $2,041, $2,068

Support: $2,008, $1,985

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 16:15 | 43.3 |

| EUR | French Flash Services PMI | 16:15 | 46.1 |

| EUR | German Flash Manufacturing PMI | 16:30 | 43.1 |

| EUR | German Flash Services PMI | 16:30 | 49.9 |

| GBP | Flash Manufacturing PMI | 17:30 | 47.6 |

| GBP | Flash Services PMI | 17:30 | 51.0 |

| USD | Empire State Manufacturing Index | 21:30 | 2.0 |

| USD | Flash Manufacturing PMI | 22:45 | 49.5 |

| USD | Flash Services PMI | 22:45 | 50.7 |