The stock market endured its third consecutive session of decline as investors grappled with the latest earnings reports and economic indicators, compounded by a surge in interest rates to new highs. The Dow Jones Industrial Average experienced a notable drop of 290.91 points, or 0.84%, marking its first close below the 50-day moving average since early June. This downturn raised concerns about a potential downtrend. Similarly, the S&P 500 and Nasdaq Composite also faced losses of 0.77% and 1.17%, respectively, exacerbating the market’s unease.

The unsettling trend was exacerbated by the 10-year U.S. Treasury yield’s climb to levels unseen since October 2022. The rise in rates followed the Federal Reserve’s release of minutes from its July meeting, which highlighted lingering concerns about the risk of inflation surging upward. The market witnessed a mix of outcomes among major companies, with retail giant Walmart’s stock dipping over 2%, despite exceeding expectations for earnings, revenue, and revised annual projections. Conversely, computer networking company Cisco Systems bucked the trend, gaining more than 3% thanks to its better-than-anticipated quarterly earnings report. As the market faced a turbulent August, characterized by losses and a broad index slump of over 4%, analysts like Chris Fasciano from Commonwealth Financial Network acknowledged the pullback as a potentially healthy recalibration after an earlier robust rally.

While some respite was found in the form of lower jobless claims and a positive uptick in the Philadelphia Federal Reserve’s manufacturing index for August, the overarching narrative remained one of caution and uncertainty as investors navigated through the intricate interplay of earnings releases, economic data, and interest rate fluctuations.

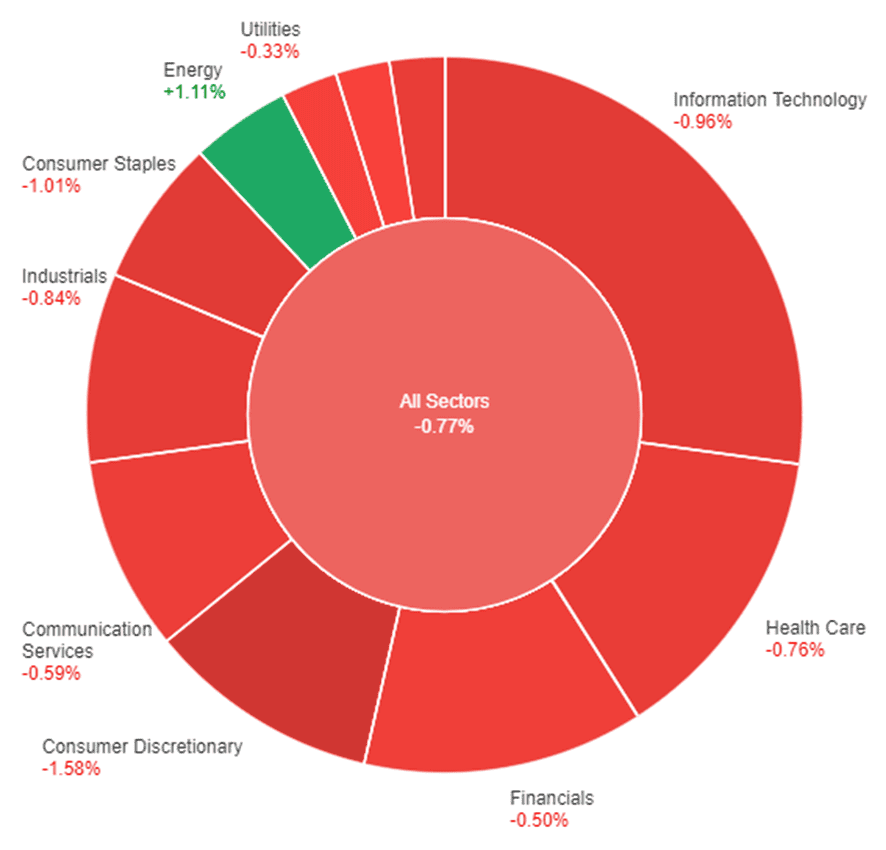

Data by Bloomberg

On Thursday, the stock market witnessed a mixed performance across various sectors. Energy saw a notable gain of +1.11%, while materials experienced a slight decline of -0.18%. The utilities and financial sectors also dipped, with losses of -0.33% and -0.50% respectively. Communication services and real estate faced setbacks of -0.59% and -0.75%, while health care and industrials both saw decreases of -0.76% and -0.84%. The information technology sector experienced a larger drop of -0.96%, while consumer staples and consumer discretionary sectors recorded more significant declines of -1.01% and -1.58% respectively.

Major Pair Movement

Amidst risk aversion and rising Treasury yields, the US Dollar surged across the board during the American session. The Dow Jones index faced a third consecutive day of losses, sliding by 0.85% and registering its lowest close in a month. Concerns about China’s economic prospects combined with expectations of prolonged higher interest rates contributed to market unease.

US Treasury yields displayed a mixed performance, with the 10-year yield hitting 4.32%, its highest since 2007, before retracting, while the 30-year yield rose to 4.42%, its peak since 2011. The US Dollar Index ended the day steady at 103.40 after briefly touching two-month highs at 103.59.

US Initial Jobless Claims dropped to 239,000 for the week ending August 12, surpassing expectations. However, Continuing Jobless Claims increased to 1.716 million in the week ending August 5, reaching their highest point in four weeks. The Philadelphia Fed Manufacturing Survey provided a positive surprise by climbing from -13.5 to 12.

Looking forward, attention shifted to the upcoming Jackson Hole Symposium, as Friday’s US releases were not anticipated to be top-tier. The EUR/USD initially rose before declining during American trading hours, marking a six-week low. The Japanese Yen recovered ground despite rising government bond yields, benefiting from equity market declines and a slight US Dollar slowdown. GBP/USD experienced significant gains but failed to hold above the 20-day Simple Moving Average, while the Australian jobs report impacted the Aussie’s performance. USD/CAD continued its upward trajectory, and NZD/USD fell before slightly recovering from its lows.

Picks of the Day Analysis

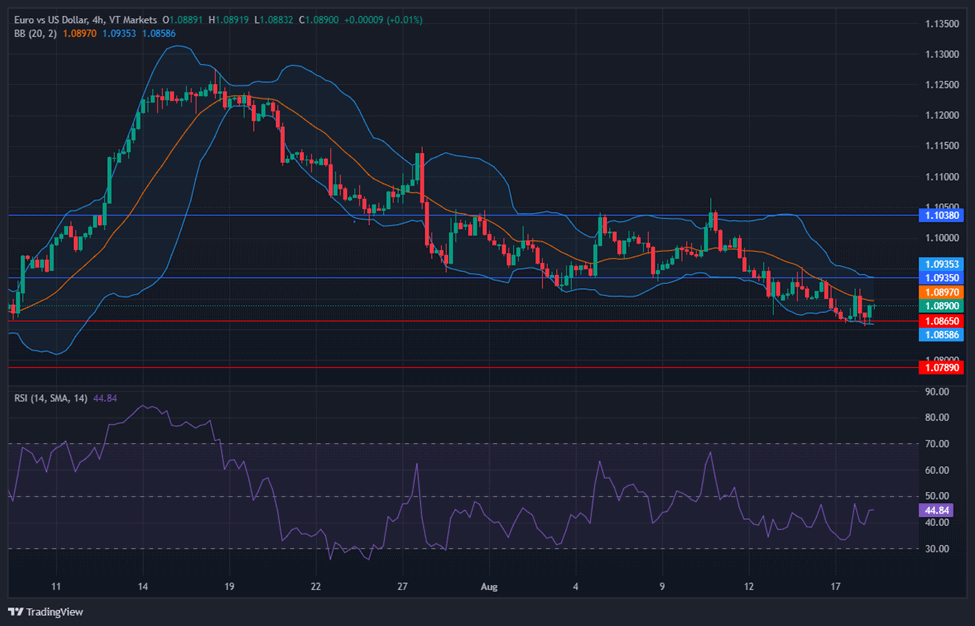

EUR/USD (4 Hours)

EUR/USD Extends Losses Amidst Dollar Strength and Market Caution

During the American session, the EUR/USD currency pair faced its fifth consecutive day of decline, shifting into negative territory. The US Dollar maintained its robust stance, benefiting from risk aversion and higher Treasury yields. Initially rising to approximately 1.0920, the pair later weakened, settling around the 1.0860 range.

The Euro’s initial surge in the American session gave way to a reversal, driven by the diminishing yield difference between US and German bonds, which exerted downward pressure on the EUR/USD. Furthermore, a drop in equity values amplified demand for the US Dollar. Looking ahead, Eurostat is set to release the final July Consumer Price Index, expected to hold no significant surprises with an annual rate of 5.3%. Additionally, Construction Output data for June will also be reported.

The prevailing narrative continues to favor the US Dollar, supported by recent US economic indicators and a climate of general market caution. As such, any potential recoveries in the EUR/USD are likely to be restricted until a shift in market sentiment occurs.

Based on technical analysis, the EUR/USD moves lower on Thursday, creating a push for the lower band of the Bollinger Bands. Currently, the price is moving around the middle band of the Bollinger Bands. The Relative Strength Index (RSI) presently stands at 44, signifying that the EUR/USD is currently in a bearish sentiment with a potential to goes back to neutral stance.

Resistance: 1.0935, 1.1038

Support: 1.0865, 1.0789

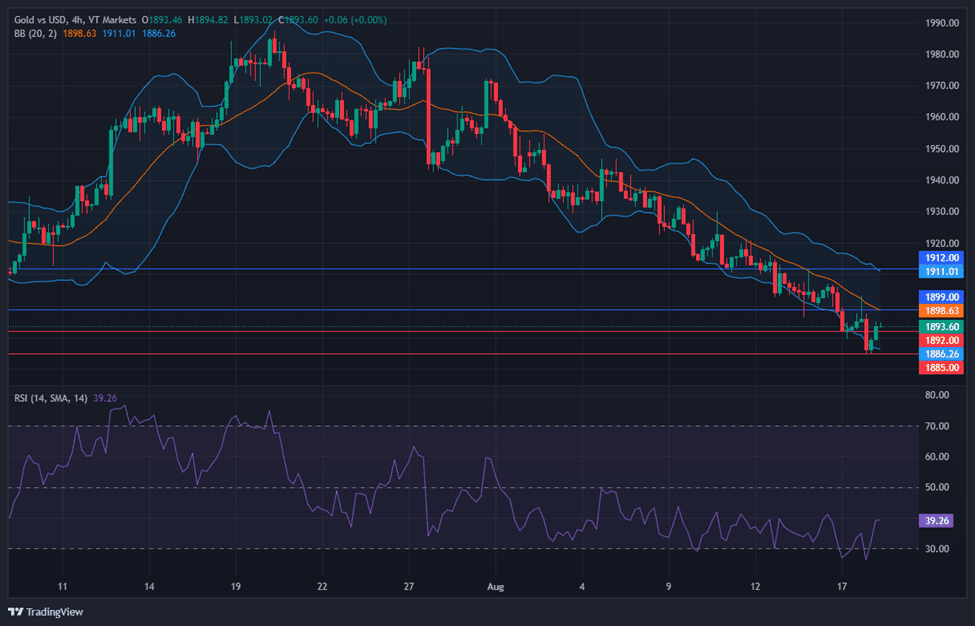

XAU/USD (4 Hours)

XAU/USD Hits Lowest Levels Since March Amid Gloomy Market Mood and Central Bank Concerns

Gold prices are facing downward pressure, falling to their lowest since March and hovering around the $1,890 mark, as a somber market sentiment persists. The risk-averse stance among investors was triggered by the US Federal Reserve’s recent release of the August meeting minutes, revealing apprehensions regarding inflation risks and potential for further rate hikes. This uncertainty extends beyond the Fed, with the Bank of England hinting at prolonged rate hikes and the Reserve Bank of New Zealand considering potential increases in the future. Amid these central bank concerns, gold’s value remains under strain.

Based on technical analysis, the XAU/USD witnessed a slight decrease on Thursday, the price managed to create a push for the lower band of the Bollinger Bands during this movement. Currently, the price is moving near the middle band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 39, indicating that the XAU/USD pair is exhibiting a somewhat bearish sentiment.

Resistance: $1,899, $1,912

Support: $1,892, $1,885