On Tuesday, stock markets faced a sharp decline following unexpectedly high January inflation data, which sent Treasury yields climbing and dampened hopes for multiple Federal Reserve rate cuts this year. The Dow Jones Industrial Average recorded its worst session since March 2023, plummeting by 1.35%, while the S&P 500 and Nasdaq Composite also saw significant drops. This inflation surprise, indicated by a higher Consumer Price Index (CPI) rise than forecasted, rattled investors, leading to steep losses in tech giants like Microsoft and Amazon. Meanwhile, currency markets adjusted to the new data, with the dollar strengthening and shifts in expectations for the Fed’s monetary policy. The inflation report underscores ongoing inflationary pressures, despite a slight year-over-year decrease, challenging the outlook for interest rate adjustments and impacting global financial markets.

Stock markets experienced a significant downturn on Tuesday, triggered by January’s inflation data, which came in hotter than anticipated. This unexpected rise in inflation heightened Treasury yields and cast doubt on the Federal Reserve’s ability to implement multiple rate cuts throughout the year. This prospect had previously buoyed equity market optimism. The Dow Jones Industrial Average saw its worst session since March 2023, dropping 1.35% to close at 38,272.75. Similarly, the S&P 500 and the Nasdaq Composite fell by 1.37% and 1.8%, respectively, while the Russell 2000 index faced a near 4% decline, marking its most significant drop since June 2022. The Consumer Price Index (CPI) rose by 0.3% for the month, surpassing economists’ expectations and signaling a 3.1% increase on an annual basis.

The report also noted a higher-than-expected rise in core prices, which exclude volatile food and energy components, indicating a 0.4% month-over-month increase and a 3.9% rise from the previous year. This inflation data sent the 2-year and 10-year Treasury yields soaring, adversely impacting tech stocks such as Microsoft and Amazon, both of which led the market’s losses after having previously driven the market to record highs. Meanwhile, in corporate news, JetBlue Airways’ stock surged almost 22% following news of Carl Icahn acquiring a nearly 10% stake, contrasting with Hasbro and Avis Budget Group’s shares, which fell after disappointing fourth-quarter performances.

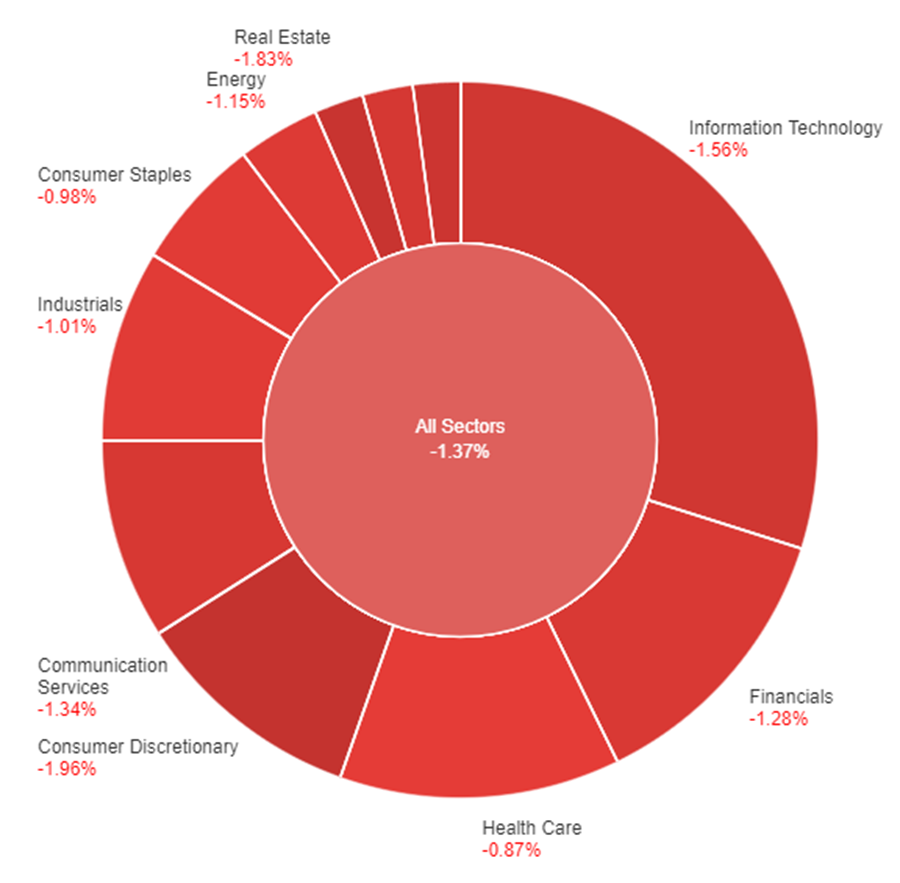

Data by Bloomberg

On Tuesday, the market experienced a widespread downturn across all sectors, with the overall market declining by 1.37%. The sell-off was led by the Consumer Discretionary sector, which saw the steepest decline at -1.96%, closely followed by Real Estate and Utilities, which fell by -1.83% and -1.69%, respectively. Information Technology also saw a significant drop, decreasing by -1.56%. On the less severe end, the Health Care, Consumer Staples, and industrial sectors experienced relatively smaller losses, declining by -0.87%, -0.98%, and -1.01%, respectively. This broad market pullback reflects a cautious or negative sentiment among investors across virtually all sectors of the economy.

In the recent currency market updates, the dollar index witnessed a notable rise of 0.65%, largely influenced by the U.S. Consumer Price Index (CPI) data, which came in above forecasts. This development has adjusted market expectations regarding the Federal Reserve’s monetary policy, pushing the anticipated timing of the first rate cut from May to June and scaling back the expected total easing in 2024 to under 100 basis points, a significant reduction from the nearly 150 basis points anticipated in January. Despite the overall year-on-year inflation rate decreasing from 3.4% to 3.1% and the core rate remaining at 3.9%, the increase in the core’s 3-month annualized rate to 4.0%—its highest since June—along with a rise in the six-month annualized rate to 3.6%, signals persistent inflationary pressures. These figures have led to an uptick in both 2-year and 10-year Treasury yields, thereby widening the yield spreads over German bunds and Japanese Government Bonds (JGBs), albeit to a lesser extent over UK Gilts, which found support from unexpectedly high UK wage growth data.

The currency pair movements reflected these broader economic updates, with the EUR/USD pair declining by 0.56%, yet managing to hold above the 1.0700 mark. The market’s attention now turns to the upcoming retail sales data, which could further influence the dollar’s trajectory and potentially trigger a move toward the 1.0500 level, echoing the sentiment from the Fed’s December projections. On the other hand, the USD/JPY pair saw a significant increase of 0.94%, surpassing the 150 mark and indicating a possible retest of the 2022/23 peaks unless there’s intervention from Japan’s Ministry of Finance. The Sterling experienced a slight decline of 0.3%, even after an initial surge, influenced by bullish UK job data and upcoming economic reports that are expected to play a crucial role in Bank of England’s policy decisions and the pound’s valuation. The Australian dollar also faced a downturn, dropping by 1.2% amid a broader move away from riskier assets and declining metal prices, highlighting the interconnected nature of global financial markets and commodity prices on currency valuations.

EUR/USD Dips to New Yearly Low Amidst USD Surge and Rate Cut Speculations

The EUR/USD pair experienced a significant decline, reaching a new yearly low around the 1.0700 mark as the US dollar strengthened across the board, driven by heightened expectations of a Federal Reserve monetary easing cycle potentially starting in June. This outlook was reinforced by rising US yields and a decrease in the likelihood of a May rate cut, following unexpectedly low US inflation figures. Meanwhile, in Europe, despite positive economic sentiment indicators from Germany and the broader euro area, concerns over the economic situation and expectations of ECB interest rate cuts reflect growing economic uncertainty. The ECB’s cautious stance on the timing and extent of future rate cuts underscores the delicate balance central banks are navigating in their efforts to control inflation while supporting economic growth.

On Tuesday, the EUR/USD moved lower and reached the lower band of the Bollinger Bands. Currently, the price is moving just above the lower, suggesting a potential slightly upward movement to reach the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 32, signaling a bearish outlook for this currency pair.

Resistance: 1.0725, 1.0796

Support: 1.0662, 1.0595

XAU/USD Plummets to Two-Month Low Amid Surging US Inflation and Dollar Strength

Gold prices tumbled to their lowest in two months, hitting $1,989.97 per ounce, as the US revealed stronger-than-expected inflation data, prompting a sharp rally in the US Dollar. The US Consumer Price Index (CPI) for January indicated a monthly rise of 0.3% and a core inflation increase of 0.4%, both surpassing market forecasts. This inflationary pressure, evidencing a year-over-year rise to 3.1%, has bolstered the Federal Reserve’s cautious stance on monetary policy adjustments, leading to a surge in risk aversion across financial markets. Consequently, gold’s value has suffered significantly due to the strengthened US Dollar and shifting investor sentiment.

On Tuesday, XAU/USD moved lower and reached the lower band of the Bollinger Bands. Currently, the price moving around the lower band, suggesting a potential downward movement to reach lower to the support level. The Relative Strength Index (RSI) stands at 27, signaling a bearish outlook for this pair.

Resistance: $2,004, $2,023

Support: $1,988, $1,973

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Consumer Price Index YoY | 15:00 | 4.1% |