On Tuesday, the stock market experienced a decline as investors awaited the Federal Reserve’s policy meeting outcomes later in the week, resulting in the Dow Jones Industrial Average falling by 0.31%, the S&P 500 slipping by 0.22%, and the Nasdaq Composite dropping by 0.23%. Disney and Deere faced setbacks due to investment plans and downgrades, respectively, while Instacart stood out with a gain of over 12% after going public. The Federal Reserve’s two-day meeting garnered significant attention, with a 99% probability of no interest rate hike, but investors were keen on economic forecasts, oil prices settled lower, and the U.S. Treasury yield reached its highest level in years. In the currency market, the US dollar remained stable, and the euro to US dollar pair faced resistance, while the USD/JPY rose, and the British pound saw a modest increase. The Australian and Canadian dollars both gained, with additional support from energy prices, and the New Zealand dollar rose to its highest level in five days.

On Tuesday, the stock market saw a retreat as investors anxiously awaited the outcomes of the Federal Reserve’s policy meeting scheduled for later in the week. The Dow Jones Industrial Average declined by 106.57 points, or 0.31%, closing at 34,517.73, while the S&P 500 slipped 0.22% to 4,443.95, and the Nasdaq Composite fell 0.23% to 13,678.19. Disney faced a significant setback, plummeting more than 3% following its announcement of plans to nearly double its investment in its cruise and parks business. Deere, often considered an economic activity indicator, also suffered a 3% drop after being downgraded by investment bank Evercore ISI due to concerns about agricultural production. However, grocery delivery company Instacart stood out with a gain of over 12% after going public.

The Federal Reserve’s two-day meeting, commencing on Tuesday, was the focal point for investors. While it was widely expected that the Fed would not raise interest rates in its Wednesday announcement, traders priced in a 99% probability of no hike, according to CME Group’s FedWatch tool. Only a 29% chance of a rate hike in November was anticipated. Investors are eagerly awaiting the Fed’s economic forecasts, especially regarding inflation and future monetary policy. Additionally, oil prices settled lower after reaching highs not seen since November, which seemed to boost market sentiment and lift stocks off their lows. Meanwhile, the 10-year U.S. Treasury yield hit its highest level since November 2007. In other news, the United Auto Workers union’s leadership warned of the potential for more members to strike if progress isn’t made by a Friday deadline. As a result, Stellantis saw an increase of more than 2% in its stock price, while Ford and General Motors each added more than 1%.

Data by Bloomberg

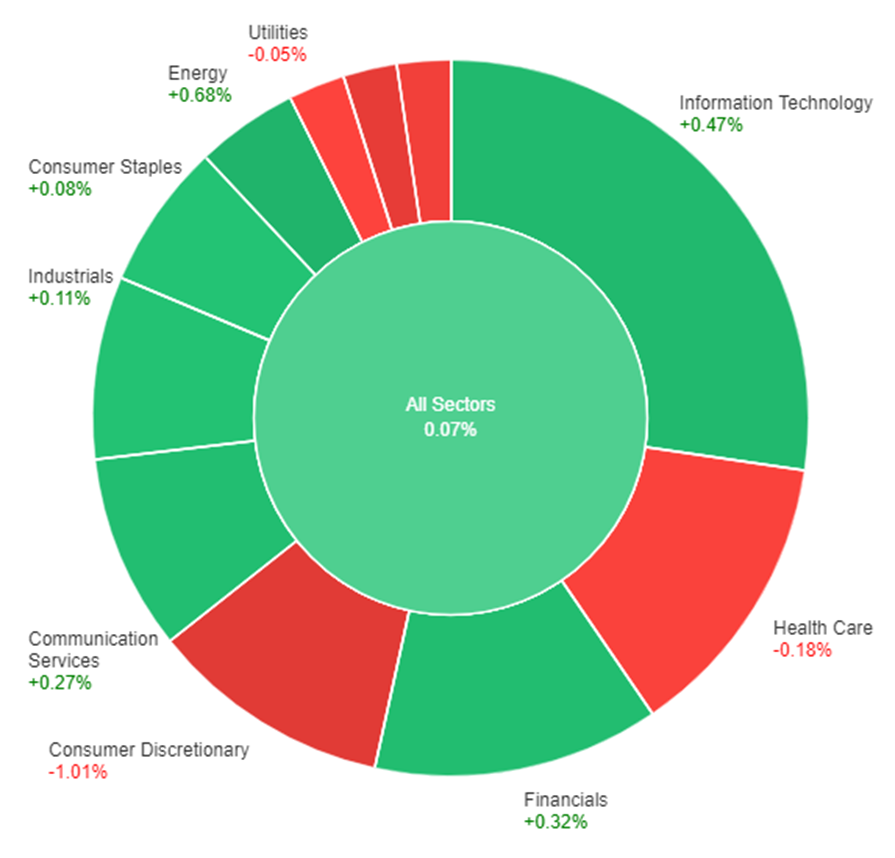

On Tuesday, across all sectors, the overall market experienced a slight decline of 0.22%. Among the sectors, Health Care showed a modest gain of 0.10%, while Communication Services and Information Technology both saw marginal increases of 0.01% and -0.08% respectively. The Materials and Financials sectors decreased by 0.10% and -0.11%, while Consumer Staples experienced a more significant decline of 0.25%. Industrials and Utilities both had substantial drops of 0.46% and 0.55% respectively. Real Estate and Consumer Discretionary sectors also saw notable decreases of 0.56% and 0.65%, while Energy had the most significant decline of 0.83%.

In the currency market, the US dollar index remained relatively stable, showing slight upward movement after earlier declines in anticipation of important events from the Federal Reserve (Fed). Investors were closely watching the possibility of the Fed providing guidance suggesting another interest rate hike later in the year. This cautious sentiment was impacting expectations for any potential interest rate cuts before the second half of 2024. The dollar index had retreated from its recent six-month highs, encountering significant resistance, as it aimed to consolidate gains made since hitting lows in July. The euro to US dollar (EUR/USD) pair was in focus, with EUR/USD having recovered from last week’s probe of the major swing low at 1.0635 but facing resistance at 1.0718. The market’s attention was shifting towards the Fed, with the expectation that it might adopt a more hawkish stance compared to the European Central Bank (ECB), which had recently raised rates, citing that they were now restrictive enough to curb euro zone inflation.

In the USD/JPY pair, the US dollar rose by 0.17%, primarily driven by a rise in Treasury yields. Two-year yields were nearing their highest level since 2006, just below the peak seen in July at 5.12%, while ten-year yields were reaching levels not seen since 2007. This development led to a narrowing of Treasury-JGB yield spreads, potentially paving the way for a breakout in USD/JPY, assuming a hawkish stance from the Fed and the Bank of Japan’s expected policy normalization delay. Meanwhile, the British pound (GBP) saw a 0.06% increase, although it retreated from intraday highs due to the US dollar’s broader rebound. Concerns were rising that the Bank of England’s anticipated rate hike on Thursday might be its last, despite persistently high UK overall and core inflation rates at 6.8% and 6.9%, respectively. In the coming days, the currency market will closely monitor CPI releases, which are forecasted to show overall and core inflation rates at 7.0% and 6.8%. Finally, the Australian and Canadian dollars both gained 0.3%, with the latter receiving additional support from above-forecast data. Both currencies benefited from the recent surge in energy prices and signs of stabilization in China’s economy, while the New Zealand dollar rose by 0.15% to its highest level in five days, though it faced challenges in breaking above the 10-day moving average.

EUR/USD Sees Modest Decline as US Dollar Strengthens Ahead of FOMC Decision

The EUR/USD pair experienced a slight decline, falling from its peak above 1.0700 as the US Dollar gained strength due to deteriorating market sentiment and higher US yields in anticipation of the Federal Reserve’s (Fed) decision. The Eurozone Harmonized Index of Consumer Price Index showed a minor revision in annual rates, while economic data from Germany and the UK were on the horizon. However, all eyes were on the forthcoming FOMC decision, with expectations of a steady Fed Fund rate and a potential warning regarding the need for further tightening if inflation persists. The market’s direction, especially that of the US Dollar Index (DXY), hinged on the outcome of the meeting, leading to cautious anticipation among market participants.

According to technical analysis, the EUR/USD moved flat on Tuesday and is currently trading just above the middle band of the Bollinger Bands. This movement suggests the possibility of further consolidation. The Relative Strength Index (RSI) is currently at 49, indicating that the EUR/USD is in a neutral stance. (Note: the markets are waiting for today’s Fed rate decision which will create high volatility movement).

Resistance: 1.0711, 1.0759

Support: 1.0653, 1.0605

XAU/USD Stall as USD Gains Momentum Amid Inflation Concerns and Fed Speculation

On Tuesday, gold prices showed minimal movement, hovering around the $1,930 mark for XAU/USD. The US Dollar initially faced market disfavor but saw increased demand ahead of Wall Street’s opening and after the release of the Canadian Consumer Price Index (CPI), which indicated a higher-than-expected 4% YoY inflation rate for August. This global inflationary trend, coupled with surging US government bond yields, particularly the 10-year Treasury note reaching levels not seen since 2007 at 4.36%, bolstered the Greenback’s position. While the Federal Reserve’s forthcoming monetary policy announcement is widely expected to maintain the status quo, concerns loom, and Chair Jerome Powell’s words will be closely scrutinized for hints about future rate changes. Wednesday’s release of new economic projections by the Fed is expected to have a more significant impact on the market than the decision itself.

According to technical analysis, XAU/USD moved in a tight range on Tuesday and moved between the middle and upper bands of the Bollinger Bands. Currently, the price is trading slightly above the middle band with the potential for further higher movement. The Relative Strength Index (RSI) is currently at 57, indicating that the XAU/USD pair is in a neutral stance with a bullish bias. (Note: the markets are waiting for today’s Fed rate decision which will create high volatility movement).

Resistance: $1,939, $1,951

Support: $1,928, $1,915

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Consumer Price Index | 14:00 | 7.0% |

| USD | Federal Funds Rate | 02:00 (21st Sept) | 5.50% |

| USD | FOMC Statement | 02:00 (21st Sept) | |

| USD | FOMC Press Conference | 02:30 (21st Sept) | |

| NZD | Gross Domestic Product | 06:45 (21st Sept) | 0.4% |