Stocks started the final trading week of August on a positive note, with Wall Street striving to recover from a month of losses. The Dow Jones Industrial Average surged by 0.62%, gaining 213.08 points to close at 34,559.98. The S&P 500 climbed 0.63% to reach 4,433.31, and the Nasdaq Composite advanced by 0.84% to finish at 13,705.13. August has witnessed losses across all three indexes, with the S&P 500 declining by 3.4%, and the Nasdaq and Dow slipping by about 4.5% and 2.8% respectively. The tech sector, which suffered a 4.6% drop this month, made efforts to recover as certain tech giants like Meta, Apple, and Nvidia showed slight gains. Meanwhile, other sectors, such as 3M, made notable moves driven by company news.

The rally on Monday was characterized by a broader market participation, with 10 of the 11 sectors in the S&P 500 showing positive momentum. Notably, the rally appeared to favor cyclical stocks over tech, as investors responded to stronger-than-expected growth beyond the U.S. borders. The positive sentiment followed Federal Reserve Chair Jerome Powell’s recent remarks, in which he indicated cautiousness in proceeding with further interest rate hikes despite signs of ongoing economic growth and robust consumer spending. Traders were assigning over a 20% probability of another rate hike during the upcoming September meeting. The week ahead holds significance with the release of the Fed’s preferred inflation gauge, the personal consumption expenditures index, and fresh non-farm payroll data.

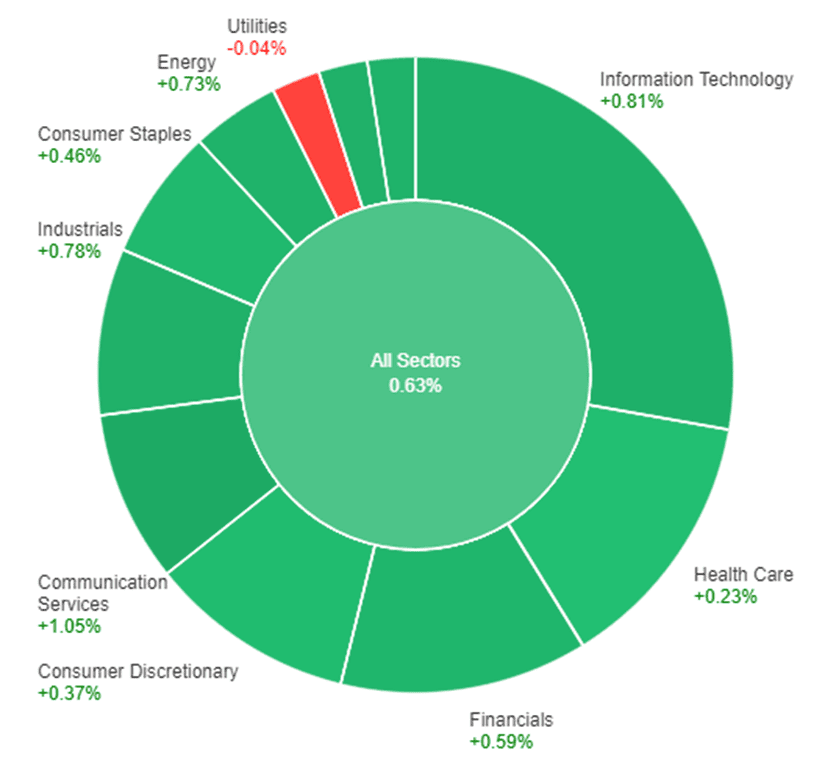

Data by Bloomberg

On Monday, the overall market saw a positive movement of 0.63%. The Communication Services sector led the gains with a notable increase of 1.05%, followed by Information Technology at 0.81% and Industrials at 0.78%. Real Estate, Materials, and Energy sectors also displayed positive growth, each rising by 0.77%, 0.74%, and 0.73% respectively. Financials experienced a moderate gain of 0.59%, while Consumer Staples and Consumer Discretionary sectors showed more modest increases of 0.46% and 0.37%. Health Care saw a slight uptick of 0.23%, while the Utilities sector had a minor decrease of -0.04%.

The dollar index showed a slight decline on Monday as London observed a bank holiday. Investors grappled with mixed messages from central bankers following the Jackson Hole symposium. While the Bank of Japan (BoJ) Governor leaned dovish, other central banks left their stance ambiguous. The market eagerly awaited upcoming key data releases for clearer guidance.

A rebound in risk appetite, partially triggered by China’s efforts to bolster its slowing growth and curb investment outflows, had a minor impact on safe-haven currencies like the dollar and yen. Meanwhile, risk-sensitive currencies such as the Australian dollar and sterling received support, rising by 0.27% and 0.19% respectively. EUR/USD gained 0.12%, and USD/JPY remained relatively stable.

Following the Jackson Hole event, the Federal Reserve is likely to raise rates by 25 basis points at its November meeting if U.S. data remains robust. The European Central Bank (ECB), facing weaker euro zone data and inflation concerns, may raise rates by 25 basis points as early as September. Fed Chair Jerome Powell emphasized the need for more data before considering rate hikes, while ECB President Christine Lagarde highlighted potential inflation risks. With the focus on upcoming euro zone and U.S. data, market attention is on economic indicators, including CPI, core PCE, employment data, and ISM manufacturing reports for August. The dollar’s trajectory against the yen depends on U.S. data and Treasury yields, while sterling remained relatively unaffected by hawkish comments from the Bank of England Deputy Governor, already priced in due to inflation concerns.

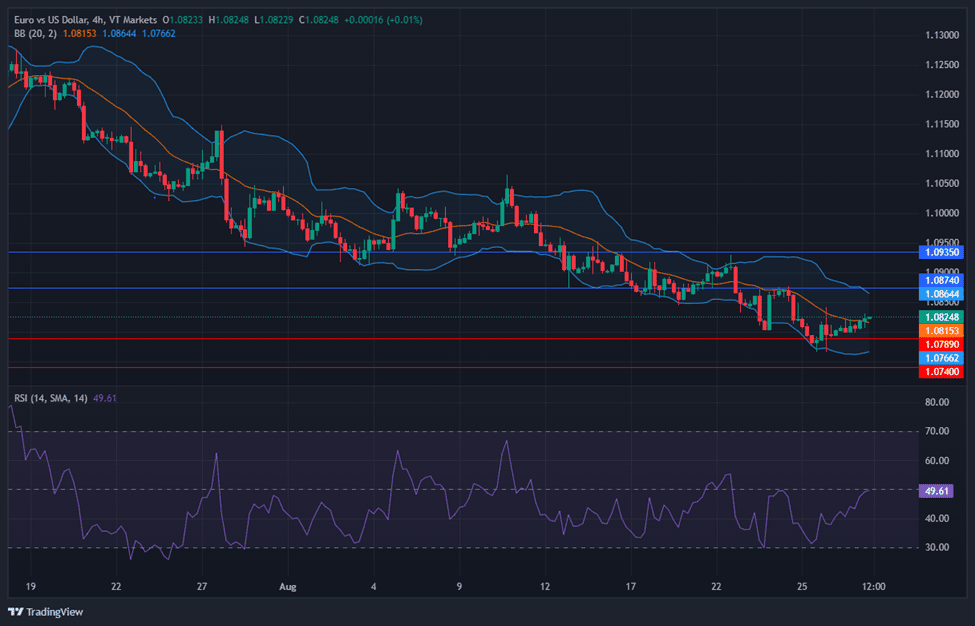

EUR/USD Rises Amid Weaker US Dollar, Markets Anticipate Key Economic Data

The EUR/USD currency pair experienced a modest increase on Monday, benefitting from a softened US Dollar after recording its lowest close since mid-June following Jerome Powell’s Jackson Hole speech. As crucial economic reports loom, there’s potential for increased market volatility.

The US Dollar started the week on a weaker note, driven by an improved market sentiment supported by China’s additional measures. This led to gains in US and European stocks and a decline in government bond yields. This environment weighed on the US Dollar, causing the US Dollar Index to retreat towards 104.00.

In terms of economic data, the Dallas Fed Manufacturing Index exhibited improvement, albeit not overwhelmingly positive. Attention is now focused on forthcoming employment and inflation data. The week’s agenda includes the release of the JOLTS Job Openings report. Similarly, European markets are keenly awaiting inflation reports, with preliminary August Consumer Price Index (CPI) data set to be unveiled across Eurozone countries. Additionally, the German Gfk Consumer Confidence survey is due for release. The convergence of these data points suggests the potential for market-moving shifts.

In line with technical analysis, the EUR/USD moves slightly higher on Monday, reaching the middle band of the Bollinger Bands. Currently, the price is moving slightly above the middle band, showing that there’s potential for another higher movement to target the upper band. The Relative Strength Index (RSI) is currently at 49, signaling that EUR/USD is trying to move back to the neutral stance.

Resistance: 1.0874, 1.0935

Support: 1.0789, 1.0740

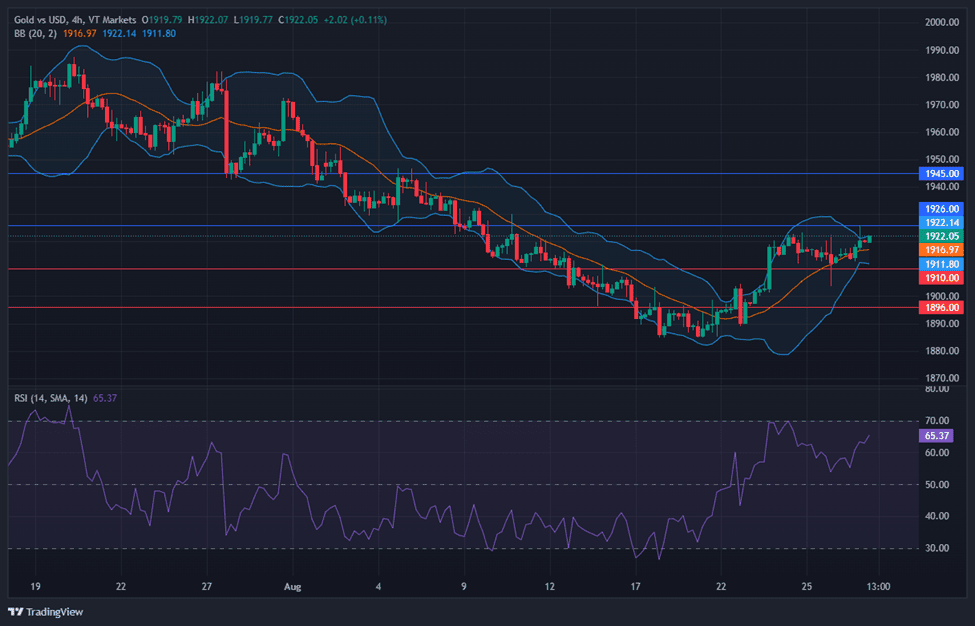

XAU/USD Surges to Three-Week High as China Initiates Measures, Market Eyes Economic Data

Spot Gold experienced a surge against the US Dollar, propelling the XAU/USD pair to a three-week high at $1,926.04 per troy ounce. The week commenced with financial markets closely observing China’s moves to bolster the Yuan. China’s economy, grappling with challenges since abandoning the zero-covid policy in December 2022, has struggled to regain pre-pandemic growth levels.

China’s reduction of the stamp duty on stock trading by 50% over the weekend, coupled with a higher-than-expected fixed rate for USD/CNY set by the People’s Bank of China (PBoC), exerted downward pressure on the USD, leading to minor losses against major counterparts. Despite this, the USD maintained its position near recent highs across currency markets. Gold experienced an uptick during the American session, partly influenced by rising government bond yields and a retreat in US indexes from their intraday highs.

However, Gold’s intraday gains were mostly reined in as market participants await key news for clearer market direction. The upcoming macroeconomic calendar features significant data releases, including Germany and the Euro Zone’s preliminary estimates of the Harmonized Index of Consumer Prices (HICP) for August. Likewise, the United States is set to publish the July Core Personal Consumption Expenditures (PCE) Price Index, a preferred inflation gauge by the Federal Reserve, along with multiple employment indicators leading up to the eagerly anticipated August Nonfarm Payrolls report on Friday.

Using technical analysis, the XAU/USD moves slightly higher on Monday and trying to widen the bands for the Bollinger Bands. Currently, the price is trying to push the upper band higher showing there’s potential for Gold to move even higher. The Relative Strength Index (RSI) is at 65 currently, showing that the XAU/USD pair is still in a positive mode.

Resistance: $1,926, $1,945

Support: $1,910, $1,896

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | RBA Gov-Designate Bullock Speaks | 15:40 | |

| USD | CB Consumer Confidence | 22:00 | 116.0 |

| USD | JOLTS Job Openings | 22:00 | 9.49M |