On Monday, the stock market experienced a significant rally, with the Dow Jones Industrial Average surging by over 500 points, pulling itself out of correction territory, while the S&P 500 and Nasdaq Composite also made substantial gains. The positive sentiment was attributed to the anticipation of the Federal Reserve’s rate decision and hopes of a pause in rate hikes. The US dollar declined as investors moved away from safe-haven assets. In the currency market, the Euro appreciated, while the British pound remained above recent lows, and the Australian dollar saw a notable rise. Market participants are closely watching central bank meetings and economic data releases that will shape currency market dynamics in the coming days.

Stocks rallied on Monday, with the S&P 500 making significant gains and ending the day out of corrected territory. The Dow Jones Industrial Average surged by 511.37 points, or 1.58%, to reach 32,928.96, marking its best day since June 2. The S&P 500 also performed well, jumping 1.2% to 4,166.82, its best performance since late August. The Nasdaq Composite rose by 1.16% to 12,789.48. Communication services were the top-performing S&P 500 sector, gaining over 2%, with mega-cap tech stocks like Amazon and Meta Platforms rising by 3.9% and 2%, respectively. These gains followed a recent dip in the S&P 500 into correction territory, shedding 2.5% for the week, and it was down more than 10% from its 2023 closing high. The positive market sentiment on Monday was attributed to a lack of new negative developments over the weekend and a perception that bad news might have already been priced into the market.

Investors were eagerly anticipating the upcoming Federal Reserve rate decision, set for Wednesday, where it was widely expected that the central bank would maintain its benchmark interest rate at the current level. With surging interest rates being a key factor behind the recent market correction, investors hoped that the Fed would signal a pause in its rate-hiking cycle. This pause could provide some relief and potentially halt the rapid rise in Treasury yields. The 10-year Treasury yield, which had previously spiked above 5%, traded around 4.89% on Monday. Additionally, investors were looking forward to the October jobs report on Friday, with hopes that any signs of a slowing labor market could persuade the Fed to keep interest rates on hold for the remainder of the year. Furthermore, Apple was set to report its earnings on Thursday, and the stock was in correction territory, down 14% from its 52-week high. Overall, the market appeared to be responding positively to the potential for stability and improved economic conditions.

Data by Bloomberg

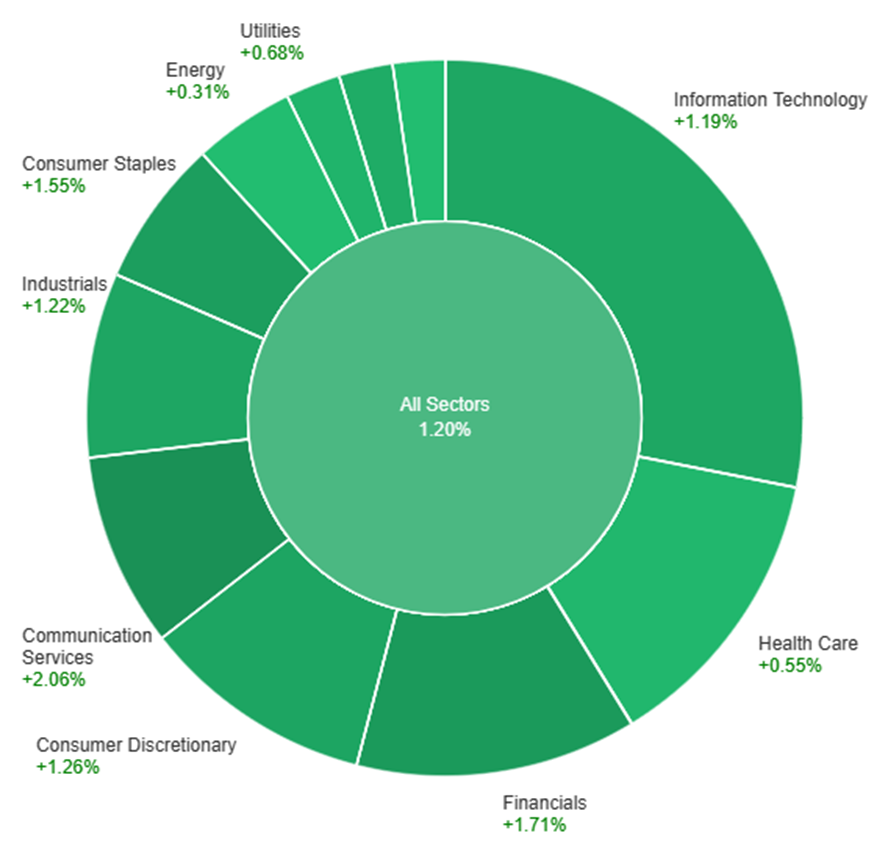

On Monday, the overall market showed a positive trend with a gain of 1.20%. Among the sectors, Communication Services saw the highest increase at 2.06%, followed by Financials at 1.71%, and Consumer Staples at 1.55%. The sectors of Energy and Real Estate had the lowest gains at 0.31%, while Health Care and Utilities also saw relatively modest increases at 0.55% and 0.68%, respectively.

In the currency market, the US dollar experienced a 0.4% decline, driven by a resurgence in risk sentiment that prompted investors to move away from the safe-haven US currency. This decrease in the dollar index occurred as market participants prepared for upcoming central bank meetings, including those of the Bank of Japan (BoJ), the Federal Reserve (Fed), and the Bank of England (BoE). Additionally, traders were bracing for a barrage of critical economic data releases, with the eagerly awaited US employment report scheduled for Friday. The most intriguing event in this lineup is the BoJ’s announcement, particularly if it entails an increase in the current 1% yield cap on 10-year Japanese Government Bonds (JGBs) and a potential shift away from aggressive JGB purchases. Such a move, if implemented, could reduce the need for aggressive quantitative easing (QE) and provide support to the Japanese yen. If the USD/JPY exchange rate breaches a key support level at 149.04, it could test the lows observed during the flash-crash on October 3, ranging from 150.165 to 147.30. Market participants are also keenly watching for the Ministry of Finance (MoF) intervention report on Tuesday to ascertain if the MoF was responsible for the sudden dive in the yen on October 3. It’s noteworthy that, among major central banks like the Fed, European Central Bank (ECB), and BoE, the BoJ is currently considered the most likely to raise interest rates next year, as it does not face expectations of cutting rates in 2024.

Meanwhile, in other currency movements, the Euro (EUR) appreciated by 0.47% against the US dollar, reaching a high of 1.0625. This upward correction followed a period of oversold conditions in October and will need to overcome the 55-day moving average at 1.0675, which had previously capped the highs in the last week of October. The German economy, however, faced a setback with a 0.1% contraction in Q3 compared to Q2, defying expectations of a 0.3% drop. Moreover, October’s inflation rate in the Eurozone came in at 3.0% year-on-year, slightly below the anticipated 3.3% and a decrease from the 4.3% rate recorded in September.

In the British pound (GBP) market, the sterling appreciated by 0.3%, remaining above the lows observed in October but staying below the downtrend line from July. This movement occurred against the backdrop of a mostly discouraging streak of economic data. The Australian dollar (AUD) also witnessed a notable 0.67% rise, benefiting from strong retail sales and a broader reduction in US dollar long positions amid decreasing risk aversion.

Looking ahead, the market’s attention is focused on key data releases, including euro zone inflation and GDP figures, followed by US data on the Employment Cost Index (ECI), home prices, and consumer confidence. Additionally, the schedule includes reports on Mortgage Bankers Association (MBA) data, the ADP employment report, ISM manufacturing data, and the JOLTS report, leading up to the post-meeting press conference by Federal Reserve Chair Jerome Powell on Wednesday. These developments are expected to further shape the dynamics in the currency market in the coming days.

EUR/USD Climbs Above 1.0600 as Dollar Weakens Ahead of FOMC Meeting and Key Data

The EUR/USD pair surged above 1.0600 during the American session, driven by a weakened US Dollar in anticipation of the upcoming FOMC meeting and crucial jobs data. The Euro received additional support from positive Eurozone economic data. Notably, Germany’s economic contraction in the third quarter was less severe than anticipated, and inflation rates in October eased below expectations. These factors support the expectation that the European Central Bank (ECB) will maintain its current stance. While the Federal Reserve (Fed) is set to keep rates unchanged, strong economic performance in the US allows for potential rate hikes in the future. Key US data releases throughout the week will influence the US Dollar’s momentum.

According to technical analysis, the EUR/USD moved higher on Monday, approaching the upper band of the Bollinger Bands. Currently, the EUR/USD is trading around the upper band, indicating the potential for a slightly lower movement. The Relative Strength Index (RSI) is at 58, signaling that the EUR/USD is in neutral bias.

Resistance: 1.0616, 1.0705

Support: 1.0500, 1.0405

XAU/USD Dips Below $2,000 Amidst Global Uncertainty and Central Bank Speculation

Gold (XAU/USD) is struggling to maintain the $2,000 mark after reaching a high of $2,009.34 last Friday, the highest level since mid-May. The demand for safe-haven assets has waned at the start of the week, impacting both Gold and the US Dollar. Global attention is focused on Middle East developments, including Israel’s ground offensive in the Gaza Strip, and anticipation is building for key central bank decisions, with the Federal Reserve, Bank of Japan, and Bank of England set to announce their monetary policies this week. Additionally, the US employment situation and upcoming economic reports are expected to influence Gold’s performance, while stock markets remain positive and Treasury yields rise, albeit not providing strong support for the US Dollar.

According to technical analysis, XAU/USD is consolidating on Monday and has the potential to reach the middle band of the Bollinger Bands, which is currently squeezing. Presently, the price of gold is consolidating near the middle band, implying a possible downward consolidation. The Relative Strength Index (RSI) is currently at 58, indicating a neutral bias for the XAU/USD pair.

Resistance: $2,007, $2,020

Support: $1,993, $1,977

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| JPY | BOJ Policy Rate | Tentative | -0.10% |

| JPY | BOJ Outlook Report | Tentative | |

| JPY | Monetary Policy Statement | Tentative | |

| JPY | BOJ Press Conference | Tentative | |

| CAD | GDP m/m | 20:30 | 0.1% |

| USD | Employment Cost Index q/q | 20:30 | 1.0% |

| USD | CB Consumer Confidence | 22:00 | 100.5 |