In a remarkable Thursday rally, stocks saw a surge as Treasury yields dropped, sparking investor speculation that the Federal Reserve may pause its rate hikes for the remainder of 2023. The Dow Jones Industrial Average posted its strongest performance since June, the S&P 500 marked its best day since April, and the Nasdaq Composite had its best session since July. All 11 S&P 500 sectors ended in positive territory, with energy and real estate leading the way. Meanwhile, the US dollar faced mixed performance in the currency market, retreating initially but recovering as Treasury yields rebounded, amid a backdrop of changing central bank signals. Despite the risk-on sentiment, market caution remained as key economic reports were on the horizon.

Stocks surged on Thursday as Treasury yields dropped, as investors speculated that the Federal Reserve might halt rate hikes for the rest of 2023. The Dow Jones Industrial Average recorded its strongest performance since June, rising 564.5 points or 1.7% to close at 33,839.08. Similarly, the S&P 500 had its best day since April, gaining 1.89% and settling at 4,317.78, marking its first back-to-back days of over 1% gains since February. The Nasdaq Composite also posted its best session since July, climbing 1.78% to close at 13,294.19. On a weekly basis, the S&P 500 was up approximately 4.9%, and the Dow had gained 4.4%, while the Nasdaq was on track for a more than 5% increase. The rally was widespread, with all 11 S&P 500 sectors ending in positive territory, led by energy and real estate, which both rose 3.1%.

The decline in bond yields was notable, with the 10-year Treasury yield falling by approximately 12 basis points to 4.668%, following its recent surge above 5%. This drop in yields was influenced by data showing easing inflation and a slowing labor market. Labor costs unexpectedly decreased in the third quarter, and weekly jobless claims ticked higher to 217,000. These developments added to investor confidence that the Federal Reserve might have finished its rate hikes. The Fed’s decision to keep interest rates unchanged for the second consecutive time on Wednesday had already triggered a substantial rally in the Dow, with the S&P 500 and Nasdaq Composite also ending up more than 1%.

Data by Bloomberg

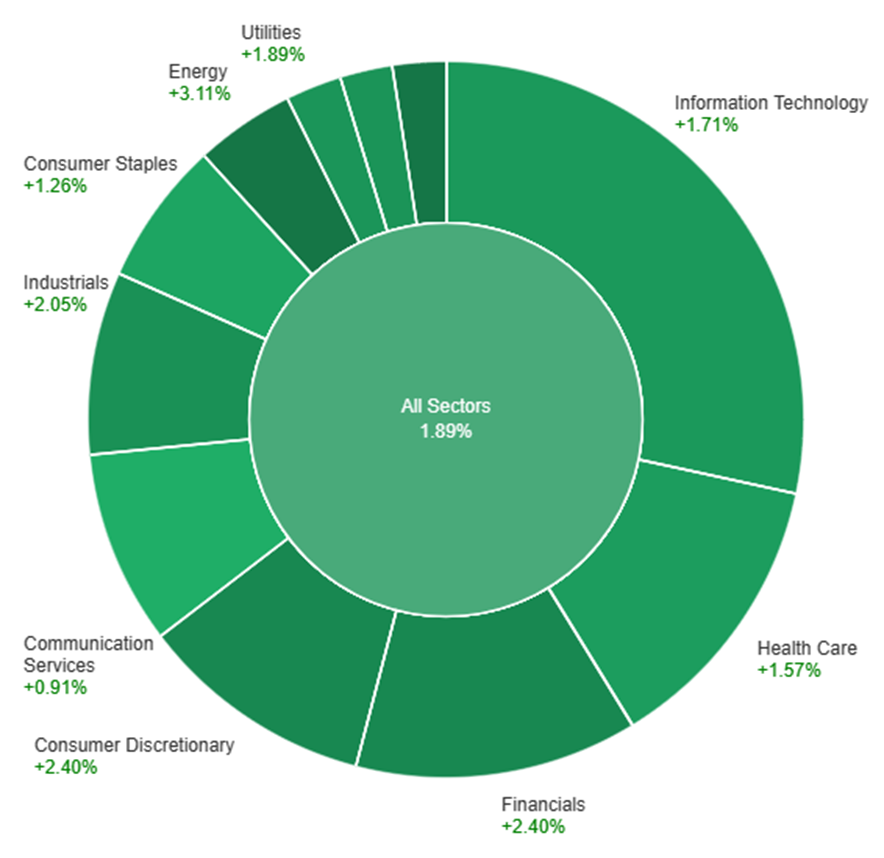

On Thursday, across various sectors, the stock market experienced a 1.89% increase. The energy and Real Estate sectors showed the strongest performance with gains of 3.11% and 3.09% respectively. Following closely, the Financials and Consumer Discretionary sectors both saw increases of 2.40%. Industrials and Materials sectors rose by 2.05% and 1.92%, while Utilities and Information Technology posted gains of 1.89% and 1.71%. Health Care and Consumer Staples sectors also advanced, albeit at a slower rate, recording increases of 1.57% and 1.26%. Lastly, the Communication Services sector showed the smallest increase at 0.91%.

In the currency market update, the US dollar faced mixed performance as it retreated on Thursday due to an unexpected drop in the US unit and a slight increase in jobless claims. However, the dollar managed to recover from its lows as EUR/USD encountered resistance, and Treasury yields rebounded, leading to a yield curve inversion. Despite a 0.5% increase in EUR/USD during afternoon trading, the currency pair was unable to surpass the 55-day moving average, which had previously capped October’s highs. To confirm that the rebound high at 1.0695 in October was not just part of an ABC correction, a close above the moving average and the daily cloud base at 1.0659/64 was necessary.

The broader market sentiment remained risk-on, with yields increasing and the safe-haven appeal of the US dollar waning as the Bank of England (BoE) and the Federal Reserve signaled that their rate hikes were likely completed. Additionally, the European Central Bank (ECB) expressed confidence in the current state of interest rates, contributing to the dollar’s decline. Despite a recessionary reading in the eurozone, the ECB’s chief economist saw a good case for a soft landing. Sterling gained 0.4% against the weakening US dollar, while USD/JPY fell by 0.34%. The Australian and Canadian dollars rose by 0.54% and 0.76%, respectively, driven by risk-on sentiment. However, with key jobs and ISM reports scheduled for Friday, risks were seen rising in the market, and investors remained cautious about the dollar’s future performance.

EUR/USD Faces Headwinds as Economic Data Paints Gloomy Picture

On Thursday, the US saw an increase in weekly Initial Jobless Claims, reaching the highest level in seven weeks, while the Unit Labor Cost dropped significantly. In the Eurozone, the Manufacturing PMI decreased, signaling a contraction in activity, with several key nations facing economic challenges. These factors could limit the Euro’s strength and pose challenges for the EUR/USD pair. Upcoming data releases, including the Eurozone Unemployment rate and US employment figures, will be closely watched, providing clarity for the direction of the currency pair.

According to technical analysis, the EUR/USD moves higher on Wednesday, approaching the upper band of the Bollinger Bands then goes back lower. Currently, the EUR/USD is trading just above the middle band, indicating the potential for a slightly lower movement to reach the middle band. The Relative Strength Index (RSI) is at 55, signaling that the EUR/USD is in neutral bias.

Resistance: 1.0645, 1.0705

Support: 1.0592, 1.0526

XAU/USD Faces Pressure from China’s Economic Woes as Traders Eye US Jobs Data for Direction

Gold (XAU/USD) is grappling with the potential impact of downbeat Chinese economic data, considering China’s status as the world’s leading gold producer and consumer. Concerns arise as the Caixin Manufacturing PMI for October fell below expectations, raising doubts about the nation’s economic recovery. On Friday, all eyes will be on the US Nonfarm Payrolls data, Unemployment rate, and Average Hourly Earnings for October, which will guide traders in their search for trading opportunities within the gold market.

According to technical analysis, XAU/USD is moving in consolidation on Thursday and is able to reach the middle band of the Bollinger Bands. Presently, the price of gold is consolidating near the middle band, creating a possibility to push back lower. The Relative Strength Index (RSI) is currently at 47, indicating a neutral bias for the XAU/USD pair.

Resistance: $1,992, $2,007

Support: $1,977, $1,962

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Employment Change | 20:30 | 25.7K |

| CAD | Unemployment Rate | 20:30 | 5.6% |

| USD | Average Hourly Earnings m/m | 20:30 | 0.3% |

| USD | Non-Farm Employment Change | 20:30 | 178K |

| USD | Unemployment Rate | 20:30 | 3.8% |

| USD | ISM Services PMI | 22:00 | 53.0 |