U.S. stocks experienced a downturn amidst fluctuating trends, impacted by a drop in inflation and looming job market reports. The Dow Jones and S&P 500 faced consecutive losses, a rare occurrence since October, despite initial optimism from economic indicators. Investors remain watchful, especially regarding upcoming labor-related data releases, notably the November nonfarm payrolls report. European markets saw rebounds, but individual stock performances diverged. Currency markets witnessed the EUR/USD pair declining, potentially signaling a saturation point for rate cut expectations by the ECB and the Fed. Concerns about disinflationary trends arose due to underwhelming economic data. The Sterling approached critical levels against the dollar, influenced by declining yield spreads. Additionally, oil markets saw significant declines, reflecting worries about a global economic slowdown overshadowing OPEC+ supply cuts.

U.S. stocks faced a downturn, grappling with fluctuating trends amid data revealing a drop in inflation and a significant jobs report on the horizon. The Dow Jones fell by 0.19%, closing at 36,054.43, marking the third consecutive losing day for both the Dow and the S&P 500, a rare occurrence since October. Initially buoyed by favorable economic indicators—such as declining labor costs and increased productivity—the market struggled to maintain its gains, fluctuating throughout the session. Investors remain vigilant as they assess various labor-related data releases, particularly scrutinizing the ADP report, which hinted at a potential easing in the job market, a crucial concern for the Federal Reserve.

However, uncertainties loom as investors eye upcoming data, particularly the eagerly awaited November nonfarm payrolls, wages, and unemployment rate figures scheduled for release on Friday. Despite the recent declines, questions emerge about whether this reflects a temporary pause in the late 2023 rally or signals a potential overextension of the market’s rapid ascent. Meanwhile, European markets rebounded, with the Stoxx 600 index rising by 0.6%, driven by surges in sectors like mining and autos, even as specific stocks like H&M experienced dips following a downgrade by Deutsche Bank analysts. In the Asia-Pacific region, markets rebounded after a previous sell-off, contributing to a positive turn in U.S. stocks during Wednesday’s morning trade following consecutive days of decline.

Amidst these fluctuations, individual stocks experienced divergent performances: Cloud company Box saw a more than 10% tumble due to third-quarter results falling below expectations, while homebuilder stock Toll Brothers gained nearly 2% after surpassing projections on both revenue and earnings. Additionally, telecom company Nokia faced a 6% drop following news of a partnership between U.S. giant AT&T and Ericsson for a next-generation wireless network rollout. In Europe, travel group Tui experienced a 14% increase in its stock value, backed by a significant rise in full-year profit and a promising forecast for operating profit growth in 2024.

Data by Bloomberg

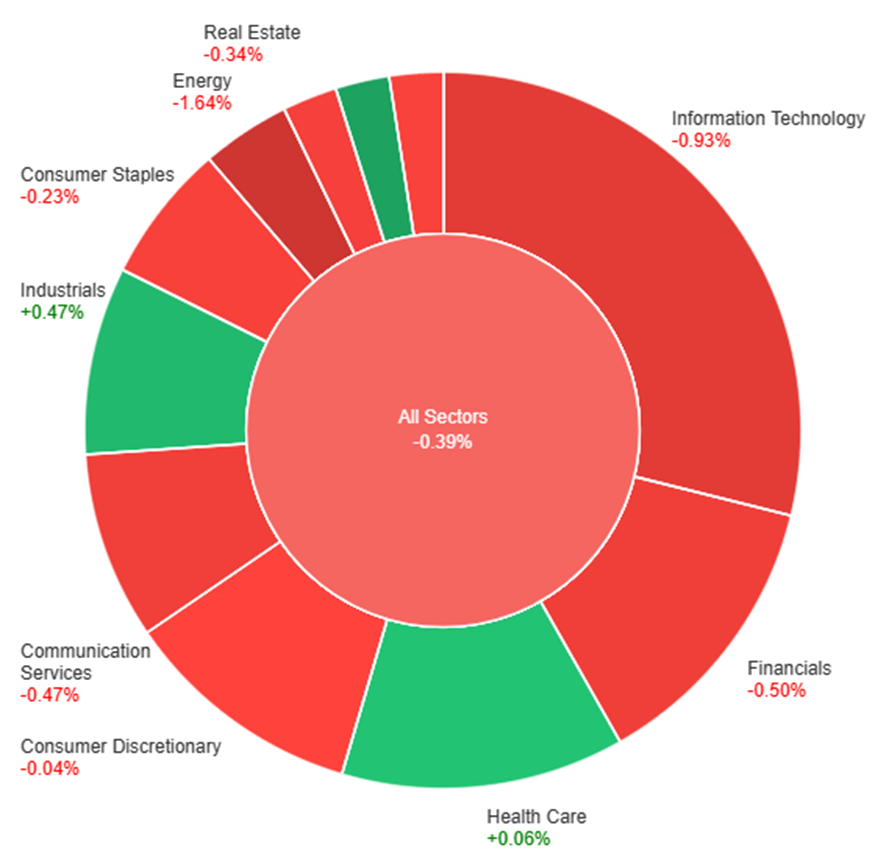

On Wednesday, most sectors experienced a slight downturn with the overall market showing a decrease of 0.39%. Utilities saw a positive trend, gaining 1.38%, followed by Industrials at 0.47% and Health Care at a minimal 0.06% increase. Conversely, Energy faced the most significant decline, plummeting by 1.64%, while Information Technology also saw a considerable drop of 0.93%. Other sectors like Consumer Discretionary, Materials, Consumer Staples, Real Estate, Communication Services, and Financials also registered decreases ranging from -0.04% to -0.50%.

In the recent currency market updates, the EUR/USD pair experienced a mild decline amidst a backdrop of various economic indicators and central bank sentiments. Despite a decrease in yield spreads between 2-year bunds and Treasury bonds, the pace of losses for the pair slowed, possibly indicating a saturation point for expectations of rate cuts by the ECB and the Fed in the coming year. The dollar faced challenges due to lower-than-anticipated ADP and unit labor cost figures, contributing to concerns about disinflationary trends, compounded by underwhelming JOLTS data. As market speculation already prices in future rate cuts by the Fed and the ECB, the focus has shifted to upcoming economic reports, particularly Thursday’s jobless claims, Friday’s employment report, and next Tuesday’s CPI figures, to gauge their impact on altering expectations for Fed rate cuts relative to the ECB’s stance.

EUR/USD’s decline to 1.07725 lows followed unexpected plunges in German industrial orders, reflecting a pattern of increasingly negative German economic data. While ECB representatives like Peter Kazimir echoed sentiments aligning with the view that rate hikes seem improbable, the possibility of swift rate cuts remains uncertain. Meanwhile, the USD/JPY pair saw a marginal increase, navigating a potential reversal from its 2023 uptrend, with key technical thresholds breached this week. Market anticipation for a downtrend revival, possibly leading to a move towards 144.58, relies heavily on forthcoming U.S. employment and inflation data reinforcing expectations of substantial Fed rate cuts.

Elsewhere, the Sterling approached a critical support level at 1.2569 against the dollar, influenced by declining Gilt-Treasury yield spreads. Market attention has turned to the upcoming BoE meeting, particularly monitoring the policy vote split, as expectations lean toward potential rate cuts as early as May, with projected cuts of 84 basis points by year-end, amid risks outlined in the BoE’s Financial Stability Report. Additionally, in the oil market, WTI experienced a significant decline of over 4%, while Brent hit its lowest point since June. These movements reflect growing concerns about a potential slowdown in the global economy, overshadowing the impact of OPEC+ supply cuts, as market sentiment increasingly focuses on demand-side risks.

EUR/USD Continues Decline Amidst Economic Indicators and Central Bank Signals

The EUR/USD pair sustained its sixth consecutive day of decline, plunging below 1.0770, marking its lowest point since mid-November. This downward trend stems from a weakened Euro juxtaposed against a robust US Dollar, intensifying pressure on the currency pair. Anticipation hovers around US job data, where the European Central Bank’s (ECB) projected rate cuts for 2024, ahead of the Federal Reserve (Fed), have notably impacted the EUR/USD dynamics. Despite subpar US data failing to prompt significant movement, the German 10-year bond yield’s drop, surpassing its US counterpart, indicates a complex market sentiment. Eurozone Retail Sales and Germany’s Factory Orders, showcasing mixed results, contribute to the growing expectation of ECB easing. Meanwhile, in the US, the ADP report hinted at a tightening labor market but failed to deter the resilient Dollar. With upcoming critical events such as Jobless Claims, Nonfarm Payrolls, the Consumer Price Index (CPI), and the impending FOMC decision, the market focus remains intensely fixated on the EUR/USD trajectory amidst these economic indicators and central bank signals.

On Wednesday, the EUR/USD experienced a downward movement, creating a push to the lower band of the Bollinger Bands. Currently, the price moving slightly above the lower band, suggesting a potential upward movement, potentially reaching the middle band before goes back lower. Notably, the Relative Strength Index (RSI) maintains its position at 27, signaling a bearish outlook for this currency pair.

Resistance: 1.0825, 1.0920

Support: 1.0760, 1.0664

XAU/USD Consolidates Amid Economic Data and Dollar Strength

Gold (XAU/USD) experienced a notable shift as it recovered from recent lows near $2,008 following its pullback from record highs above $2,130. Currently consolidating around the $2,030 support level, the metal finds itself grappling with lower Treasury yields while facing a resilient US Dollar. Despite softer employment figures and declining 10-year Treasury yields, Gold’s upward momentum remains subdued. The metal retains a bullish long-term trend, yet it’s notably distant from its recent historic peaks, with its stability hinting at a complex interplay of economic data and currency strength. The looming release of further US employment data stands poised to influence Gold’s trajectory in the coming days.

On Wednesday, XAU/USD moved slightly higher trying to reach the middle band of the Bollinger Bands. The current movement suggests a potential upward trend, possibly reaching the middle band. The Relative Strength Index (RSI) stands below 48, indicating a neutral sentiment for this pair.

Resistance: $2,031, $2,041

Support: $2,016, $2,006

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 21:30 | 221K |